SECURING CRITICAL MINERALS

Shutterstock AI

Miners know that the global drive toward a sustainable energy future hinges on the reliable supply of critical minerals such as lithium, copper, cobalt, and rare earth elements. However, the mining sector faces a formidable array of obstacles that threaten to undermine the pace and success its efforts to provide the raw materials for the energy transition. The World Economic Forum’s 2024 report, Securing Minerals for the Energy Transition: Unlocking the Value Chain through Policy, Investment and Innovation, looks at these challenges and outlines actionable strategies for mining professionals to address them.

Barriers

The report’s authors note familiar obstacles to increasing critical minerals supply. “Financial barriers include high and uncertain capital expenditures for mining projects, insufficient business cases for scaling innovations and the financial risks of investing in early-stage innovation. Barriers in the enabling environment include lengthy permitting timelines, policy complexity, perceptions of the mining industry, lack of supporting infrastructure and skilled labour, and insufficient clarity in demand-side signals and prioritized innovation needs.”

They note further: “Cross-cutting barriers include a lack of environmental, social and governance (ESG) standardization, the commercial risks of scaling and deploying innovations and a lack of transparency on minerals supply and demand data.” On top of this, geopolitical risks, trade restrictions, and concentration of supply in a few regions add further uncertainty.

Actionable Steps for Miners

To overcome these barriers and secure the minerals essential for the energy transition, the authors propose a multi-pronged strategy:

- Mobilize and De-Risk Investment

- Seek direct and indirect financial support through partnerships with public sector entities, development banks, and private investors. Examples include government-backed loans, tax credits, and equity stakes that de-risk mining projects and attract private capital.

- Leverage innovative financing mechanisms, such as streaming agreements, joint ventures, and offtake agreements, to secure funding and lock in demand.

- Accelerate Innovation and Adoption

- Invest in R&D and pilot projects to develop and scale new extraction, processing, and recycling technologies. Public-private partnerships and accelerator programs can help bridge the gap from concept to commercialization.

- Focus on supply-side innovations (e.g., advanced ore sorting, tailings reprocessing) and demand-side measures (e.g., material substitution, recycling) to enhance efficiency and reduce resource intensity.

- Streamline Permitting and Strengthen Policy Engagement

- Advocate for streamlined and harmonized permitting processes to reduce administrative delays without compromising ESG standards. Engage proactively with regulators to clarify requirements and establish predictable timelines.

- Collaborate with industry associations and governments to shape stable, long-term policy frameworks that support investment and innovation.

- Build Social License and Community Partnerships

- Engage early and transparently with local communities to address concerns, share benefits, and demonstrate commitment to high ESG standards. “Without an open dialogue between companies and communities, distrust could cause resistance that halts or hinders investment.”

- Support local employment, training, and downstream value-add activities to ensure equitable distribution of benefits.

- Invest in Infrastructure and Workforce Development

- Collaborate with governments and other stakeholders to develop shared-use infrastructure that lowers costs and accelerates project timelines.

- Invest in workforce training, reskilling, and partnerships with educational institutions to address talent shortages and evolving skill needs.

- Enhance Data Transparency and ESG Standardization

- Participate in industry initiatives to improve data transparency, traceability, and reporting across the value chain. Reliable data is essential for informed decision-making and attracting responsible investment

- Support the harmonization and enforcement of ESG standards globally to level the playing field and improve sector reputation.

- Foster Global Collaboration and Diversification

- Engage in international partnerships to diversify supply chains, share technology, and build local processing capacity in resource-rich regions.

- Support multilateral initiatives aimed at knowledge sharing, best practices, and collective action to address systemic risks.

The mining industry stands at the nexus of the energy transition, facing both unprecedented challenges and opportunities. The WEF acknowledges that miners can’t go it alone, and instead suggests that “public-private collaboration is essential to ensuring an available, affordable and sustainable global critical minerals supply-demand balance.”

Access the WEF report here.

A ROUND-THE-CLOCK CLEAN ALTERNATIVE TO FOSSIL FUELS

Achieving high levels of renewable energy is particularly challenging for off-grid mines in remote locations because intermittent PV or wind with costly batteries still require dirty, expensive diesel for backup. Many mines also require high-grade heat for on-site processing and other uses. 247Solar offers the only renewable energy technologies that:

- Integrate seamlessly with PV or wind to provide 24/7 dispatchable baseload power

- Provide industrial grade heat up to 970 ℃ (1800 ℉) for ore processing, steam generation and other applications

- Provide their own backup by burning almost any locally available fuel to produce power even when storage is depleted, eliminating gensets and reducing fuel costs up to 80%

Get in touch to learn more

RARE EARTH SPHERES OF CONTROL

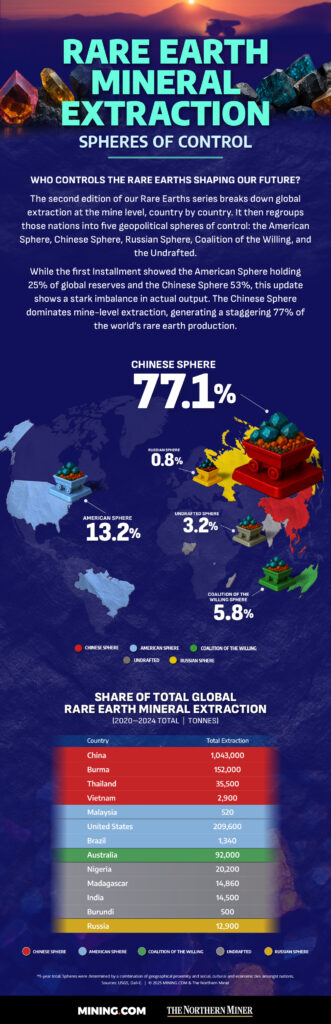

In a superb infographic from Mining.com and The Northern Miner, TNM’s Anthony Vaccaro shows how the global distribution of rare earth minerals has fractured into what he calls geopolitical “spheres of control” — groupings of nations with geographic, cultural and economic ties that align them into competing blocs. This, he says, “highlights the strategic vulnerability of Western nations and underscores the urgency of securing stable, diversified supplies.”

In a superb infographic from Mining.com and The Northern Miner, TNM’s Anthony Vaccaro shows how the global distribution of rare earth minerals has fractured into what he calls geopolitical “spheres of control” — groupings of nations with geographic, cultural and economic ties that align them into competing blocs. This, he says, “highlights the strategic vulnerability of Western nations and underscores the urgency of securing stable, diversified supplies.”

To construct the graphic, TNM’s team examined global extraction at the mine level, country by country. It then regrouped those nations into five geopolitical spheres of control: the American Sphere, Chinese Sphere, Russian Sphere, Coalition of the Willing, and the Undrafted. The illustration shows a stark imbalance in actual output. The Chinese Sphere dominates mine-level extraction, generating a staggering 77% of the world’s rare earth production.

Watch it here.

CANADA RISKS LOSING CRITICAL MINERALS RACE

Mining Weekly

A new report from the Canadian Climate Institute, reviewed by Mining Weekly, claims Canada could miss out on up to C$12-billion a year in critical minerals production by 2040 unless governments take immediate steps to de-risk investment and accelerate mining development.

The report, titled ‘Critical Path: Securing Canada’s place in the global critical minerals race’, calls for policy shifts to enable Canada to meet surging demand for six key minerals: copper, nickel, lithium, graphite, cobalt, and rare earth elements.

Although Canada holds significant reserves, current production levels remain well below what is needed to satisfy domestic and international markets.

To unlock its critical minerals potential, the report finds Canada would need to attract C$30-billion in new investment over the next 15 years to meet domestic demand alone. That number rises to C$65-billion to align with projected global demand, which the report notes is expected to double by 2040.

Unfortunately, the report asserts, “Canada’s critical minerals sector is struggling to attract enough investment to keep up with demand.”

The authors warn that the success of critical minerals projects will depend not only on market conditions, but on investor confidence, which is currently constrained by commodity price volatility and long permitting timelines.

The institute recommends that governments step in to reduce investment risk and accelerate investment. One way to do this is to share the financial risk of projects through agreements like equity investments, contracts for difference, or offtake agreements.

Int this way, governments can provide the capital that private markets won’t, sharing both the downside risks and the upside potential of projects in the face of long payback periods.

Read more here.

FOLLOW & JOIN 247Solar

LinkedIn US, LinkedinEU, Twitter, YouTube

Contact: info@247solar.com