THE BEST AND WORST PLACES FOR MINING INVESTMENT

Mining Weekly has drawn our attention to the just-released Annual Survey of Mining Companies conducted by Canada’s Fraser Institute. The report surveys executives of mining companies in order to rank various jurisdictions (provinces, states and countries) with regard to each regions’ attractiveness for mining investment.

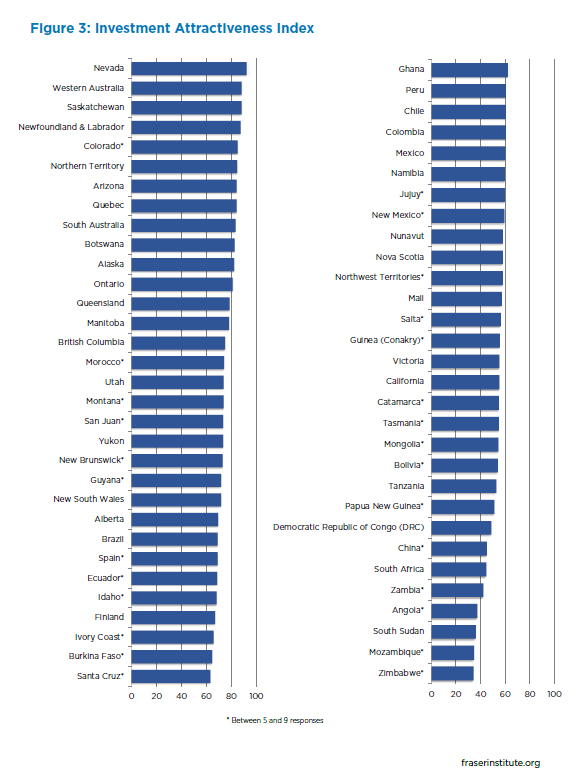

This year’s report ranks 62 jurisdictions around the world based on their geologic attractiveness (minerals and metals) as well as government policies that either encourage or deter exploration and investment. These scores are rolled together to form an overall Investment Attractiveness Index.

U.S., Australia and Canada at the top

According to the survey, the top jurisdiction in the world for investment based on the Investment Attractiveness Index is the U.S. state of Nevada, followed by Western Australia and the Canadian province of Saskatchewan. Rounding out the top 10 are Newfoundland & Labrador, Colorado, Northern Territory, Arizona, Quebec, South Australia, and Botswana.

At the bottom, the 10 least attractive jurisdictions for investment are Zimbabwe, Guinea (Conakry), Mozambique, China, Angola, Papua New Guinea, the Democratic Republic of Congo (DRC), Nunavut, Mongolia, and South Africa. The authors note that “of the 10 least-attractive jurisdictions in the world, six are in Africa.”

Policies matter

The authors note that “[mining] investment decisions are often to a considerable extent based on the pure mineral potential of a jurisdiction.” A key theme of the report is to caution that policy factors such as onerous regulations, taxation levels, the quality of infrastructure, and the other policy related questions must also be considered in evaluation locations for investment.

Access the full report here.

A ROUND-THE-CLOCK CLEAN ALTERNATIVE TO FOSSIL FUELS

An array of 247Solar HeatStorE long-duration thermal batteries

Achieving high levels of renewable energy is particularly challenging for off-grid mines in remote locations because intermittent PV or wind with costly batteries still require dirty, expensive diesel for backup. Many mines also require high-grade heat for on-site processing and other uses. 247Solar offers the only renewable energy technologies that:

- Integrate seamlessly with PV or wind to provide 24/7 dispatchable baseload power

- Provide industrial grade heat up to 970 ℃ (1800 ℉) for ore processing, steam generation and other applications

- Provide their own backup by burning almost any locally available fuel to produce power even when storage is depleted, eliminating gensets and reducing fuel costs up to 80%

Get in touch to learn more

ELECTRIC FLEETS: THE NEXT STEP ON PATH TO ALL-ELECTRIC MINE

First Mode/Energy and Mines

Two articles in Energy and Mines highlight the transition to electrified fleets as a next step toward eventual all-electric mines.

In an interview with E&M, Bernard Norton, Country Managing Director for Hitachi Energy in Australia notes for large open pit mines, digging and in-mine hauling of ore can account for between 50% and 70% of total emissions. His company is working hard to deliver a cost-effective battery-electric dump truck that charges in minutes and minimizes impact on mine operational efficiency.

A companion article in the same issue describes first-mover projects by companies on the cutting edge of fleet electrification and some of the technologies they are exploring. For example, “In Australia alone, BHP has begun operating 16 battery-electric Epiroc Jumbos at Olympic Dam; Rio Tinto is testing the Caterpillar battery electric 793 mining truck at its new Gudai Darri iron ore mine; AngloGold Ashanti is trialing a 65-ton Sandvik electric underground mining truck at the Sunrise Dam site; and Fortescue is preparing to deploy a 240-ton electric mining haul truck developed in partnership with Liebherr.”

One thing seems clear. A battery-electric approach using technology that is already available appears preferable to waiting for eventual hydrogen-based solutions. E&M quotes Shane Clark, General Manager of Strategy and Growth at MACA: “We chose the battery-electric approach rather than hydrogen because a lot of our projects are very close to renewable energy sources so it doesn’t make sense to incur the additional cost of transferring those photons through an electrolysis program into hydrogen and then deal with the cost of storing hydrogen prior to filling up your truck … It makes a lot more sense to use the energy at the source to charge an electric vehicle, and that stationary storage could help firm the grid.”

The article goes on to acknowledge the significant costs involved in transitioning entire mine fleets from one power technology to another. It highlights the efforts of companies like Komatsu, which is taking “a power-agnostic approach to truck development, allowing a mine to purchase a diesel power truck and later retrofit it with one of the company’s decarbonized solutions, [either] battery or hydrogen.”

Mines and manufacturers must collaborate

“There is no one solution that fits every mine or every piece of equipment at the mine or even every application scenario at every mine,” says Michael Lewis, Technical Director at Komatsu. Because of this, says E&M, ”Finding the right technology for a specific site requires strong collaboration between miners and their OEMs. … For miners, it involves an adjustment from purely transactional relationships, and a willingness to share longer-term plans with their OEMs.”

This last point is underscored by Norton, who says, “The pace of change is rapid, and traditional engineer-procure-construct models that focus solely on lowest cost CAPEX investment can leave customers with stranded or obsolete infrastructure. An optimized outcome therefore needs to consider whole-of-life and systems / solutions that enable and support enhancements and innovations that adapt the system over time.”

Read both Energy and Mines articles here.

MINERS POISED FOR NEW WAVE OF MERGERS

The Economist writes: “Years of discipline, a surge in commodity prices and the prospect of an explosion in demand for ‘green’ metals have mining bosses again dreaming up fantasy deals. For growth-hungry firms, the high costs and risks of developing new projects and relatively cheap valuations for companies in the sector mean that buying looks more attractive than digging.”

The Economist writes: “Years of discipline, a surge in commodity prices and the prospect of an explosion in demand for ‘green’ metals have mining bosses again dreaming up fantasy deals. For growth-hungry firms, the high costs and risks of developing new projects and relatively cheap valuations for companies in the sector mean that buying looks more attractive than digging.”

The authors suggest, however, that new transactions will likely be smaller than the biggest ones of the recent past. In part, this is because firms are starting to separate legacy assets like coal and iron from higher-profile green metals that are more attractive to investors. This enables them to form innovative combinations to take advantage of shifts in demand both toward and away from different commodities.

As an example, the article describes how Anglo American, having shed its South African thermal-coal business in 2021, has seen share price of its new company more than quadruple since its listing. “Shedding the dirtiest assets, such as thermal coal,” the authors write, “becomes more compelling as institutional investors weigh the environmental impact of their portfolios.”

Other factors are also expected to lead to an upsurge in deal-making.

Read more here.

NEWS FROM 247SOLAR

247Solar wins two First Place awards in investor pitch competitions

247Solar wins two First Place awards in investor pitch competitions

Thanks to PitchForce for the opportunity to present our breakthrough clean power and heat technologies, and for awarding us First Place in two recent Series A SELECT pitch competitions. If you are interested in joining our Series A funding round, please get in touch.

FOLLOW & JOIN 247Solar

LinkedIn US, LinkedinEU, Twitter, YouTube

Contact: info@247solar.com