FROM COAL TO GREEN HYDROGEN — FORTESCUE CUTS TO THE CHASE

Coal is fading. Green Hydrogen is the fuel of the future. Forward-thinking mining giant Fortescue is skipping the intermediate steps in transitioning from one to the other with initiatives in the U.S. and Australia. In so doing, the company is showing the way to transition from legacy sources of energy to clean power while supporting communities that are dependent on fossil fuels.

It’s not the coal

In an open letter in support of America’s recently passed Inflation Reduction Act, Fortescue Chairman Dr. Andrew Forrest says, “People aren’t married to coal, or oil or gas. They’re married to their jobs, their families, and their community. They are married to being able to put food on the table and pay the bills without having to worry.”

For both communities and mining companies likely to be affected by declining demand for coal, subsidiary Fortescue Future Industries (FFI) has a plan.

Forrest continues, “In May, we announced plans to explore converting Washington’s Centralia coal mine – slated for closure in 2025 – into a green hydrogen production facility. Here in Australia, where two-thirds of coal plants are scheduled to close before 2040, we are taking the same approach to two major facilities in New South Wales, which together account for 40 percent of the State’s emissions.”

It’s the infrastructure

Speaking of coal-producing regions in the U.S. (and by extension, elsewhere), Forrest laid out the logic. “They’re sitting on a gold mine. I am not talking about their coal, but their infrastructure.” The US (and others) can transform [their] vast network of coal-fired power stations – with their existing connections to transmission lines and electricity capacity – and repurpose them as equally industrial and far more profitable green energy and green hydrogen plants.”

And the workforce

According to a press release about the Centralia project, “FFI’s intention would be to seek to employ the existing coal workforce for the proposed project, facilitating a transition into the emerging green energy economy.” Fortescue has been working with the local community to create a win-win scenario. The release quotes Richard DeBolt, Executive Director of the Lewis (County) Economic Alliance saying, “With the closing of the coal mine and the scheduled retirement of the Centralia coal-fired power plant, [we wanted] to redevelop the site and attract investment that will support well-paid, long-term employment opportunities in the region. FFI’s potential project represents the opportunity to do just that.”

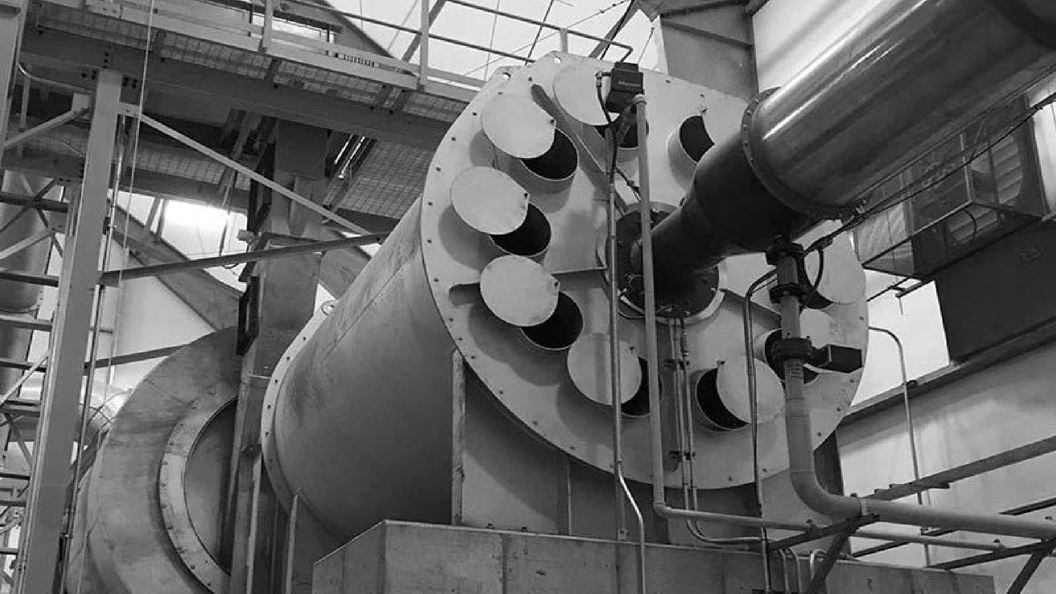

Green Hydrogen is made most efficiently by electrolysis using both clean electricity and heat. 247Solar Plants™ provide round-the-clock emissions-free power and heat so electrolyzers can operate 24/7 to produce green hydrogen at the lowest possible cost. Learn more.

GREEN ENERGY IS ALL ABOUT MINING

Thanks to Frik Els of Mining.com for underscoring the essential role the mining industry must play in the ongoing energy transition with a couple of charts and a compelling quote.

Els begins a recent article by recalling that “In 2019 Mining.com called Greta Thunberg and Alexandria Ocasio-Cortez mining’s unlikely heroines as they were saying that the “exponential expansion of global mining is the dirty little secret – and glaring blind spot – of Green New Deal evangelists and zero-carbon climate warriors.”

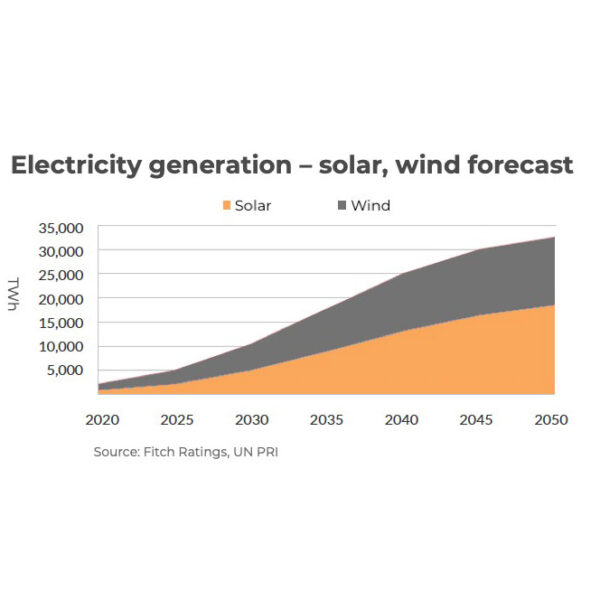

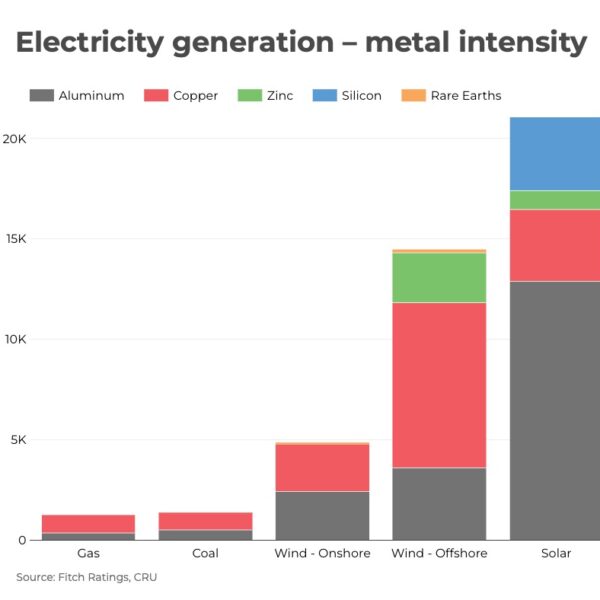

Els continues, “Fast forward three years, and there’s still little or no acknowledgment from climate [advocates] for the need for rapidly growing metal and mineral extraction.” He then demonstrates the obvious with charts from Fitch Ratings: one showing projected global demand for solar and wind power between now and 2050, and the other showing the relative metal intensity of these renewable sources compared to fossil fuels.

The clean energy needed to mitigate climate change simply can’t be produced without mining. The onus is on the mining industry to meet the world’s needs in ways that are as benign as possible toward the planet we all have an interest in preserving.

BHP READIES FOR THE ENERGY TRANSITION WITH THE PURSUIT OF OZ

Miners’ efforts to seize opportunities presented by the clean energy transition are underway. One sign: BHP’s recent $8.4 billion bid for Oz Minerals. Per Australian Financial Review via Australian Mining, “The deal would fast-track BHP’s desire to get more exposure to the metals needed for decarbonization and electrification, specifically copper and nickel.”

Although BHP’s offer was initially rejected, negotiations are ongoing. “We are mining minerals that are in strong demand for global electrification and decarbonization… and we have a long-life resource and reserve base,” says Andrew Cole, Oz Minerals’ chief executive.

However this particular deal turns out, BHP is clearly pointing the way for the rest of the extraction industry. The article suggests approaching Oz is only the latest move in “a whirlwind four years under chairman Ken MacKenzie that has seen BHP exit the vast majority of its oil, gas and coal assets.”

The writing on the wall is being heeded.

FOLLOW & JOIN 247Solar

LinkedIn, Twitter, YouTube, Whatsapp

Contact: info@247solar.com