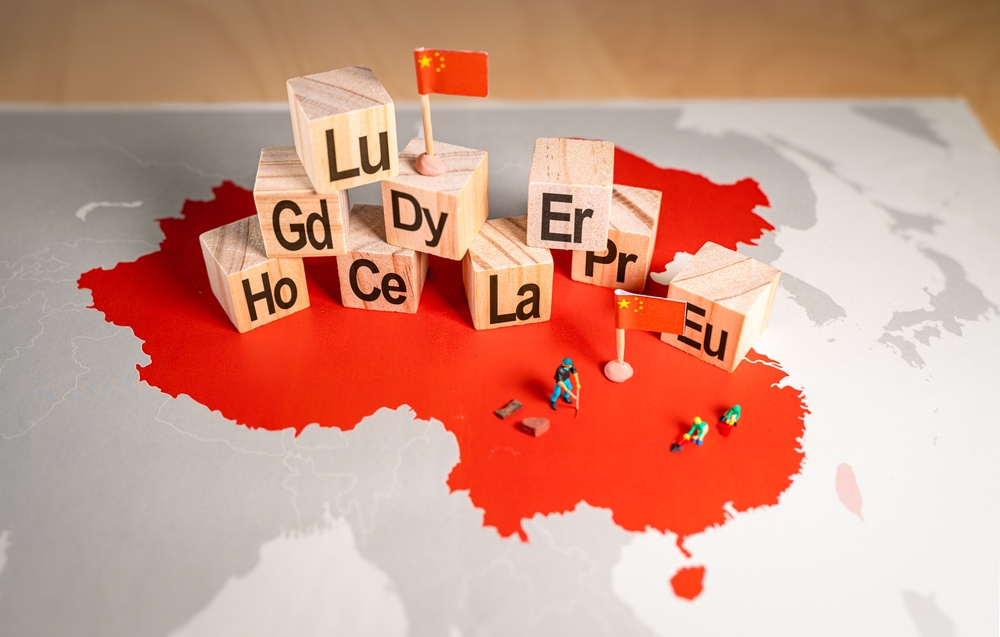

GEOPOLITICS AND MINING

Ivan Marc – Shutterstock

Mining has always been a complex business. Now, geopolitics is layering on new challenges. This was highlighted at the recent Financial Times Mining Summit, as reported in Mining Technology.

As quoted by MT’s Claire Jenns, OECD deputy director of global relations and cooperation Karim Dahou said at the Summit: “There is enhanced polarisation that threatens global value chains and can lead to further fragmentation of international trade and investment. This depends on the west and east divide, but there is also a north and south divide.”

The East-West divide is commonly understood. An earlier article, also from Mining Technology, focuses on China’s dominance in critical minerals and its implications for global manufacturing and cross-border investment. MT’s Chris Cooper writes: “As a leading producer of graphite, lithium and refined copper, China has an increasingly dominant position in critical mineral supply chains. With the necessity for these minerals driven by advanced technology and renewable energy capacity, the country’s increasing control both domestically and internationally in regions like Africa raises concerns about diminishing access for Western nations and mining companies.”

In addition to restricting access, China also uses its dominance to push down prices globally, stunting the growth prospects of emerging western rivals. Cooper quotes economic consultancy TS Lombard’s Jon Harrison, who says that while China rarely used to leverage its dominant position in the critical mineral supply chain for geopolitical ends, it has “gradually tightened its control over rare earths and other critical minerals, imposing licensing and regulatory requirements, limiting foreign companies’ access to mining, processing and related technology.”

Trade war

Harrison believes China’s leveraging of dominance in the critical mineral supply chains is in response to US measures to curb China’s access to advanced technologies. However, Copper also quotes Tom Moerenhout, a research scholar at Columbia School of International Public Affair’s Centre on Global Energy Policy, who notes that, while this plays into the “tit-for-tat games of trade restrictions” between China and the US, its dominance also allows Chinese companies the ability to push down prices and reduce competition of companies outside of China to levels that are economically unsustainable for other businesses to operate at.”

A new divide

The North-South divide is partially due to reluctance among nations in the so-called global south to reflexively align with the West. But it is also part of a Chinese strategy to adapt to frictions with the U.S. and it’s allies. Steele Li, vice-chairman and chief investment officer of Chinese molybdenum producer CMOC, said at the Financial Times Summit, “Geopolitics is not only about tension between the US and China. There is a lot of difficulty … when it comes to partnering with Western mining companies, so Chinese companies are looking at Africa or Southeast Asia instead.”

Kooper notes that “China has also been significantly investing in and acquiring overseas mines, particularly in Africa, with $10bn invested in the first half of 2023.” He cites IEA data showing that out of seven African lithium mines expected to start production by 2027, five have at least 50% equity ownership by Chinese companies.

India emerges

Against this backdrop, India is emerging as “an alternative critical materials demand and supply driver,” according India Critical Materials Security Programme founding director Gracelin Baskaran, speaking at the Summit. “We are seeing diversification and dispersion of critical minerals very quickly as a way to reduce risk … As India pushes into the renewable energy transition, it has an aggressive domestic industrial policy and is the only emerging economy in a mineral security partnership with the US.”

A ROUND-THE-CLOCK CLEAN ALTERNATIVE TO FOSSIL FUELS

Achieving high levels of renewable energy is particularly challenging for off-grid mines in remote locations because intermittent PV or wind with costly batteries still require dirty, expensive diesel for backup. Many mines also require high-grade heat for on-site processing and other uses. 247Solar offers the only renewable energy technologies that:

- Integrate seamlessly with PV or wind to provide 24/7 dispatchable baseload power

- Provide industrial grade heat up to 970 ℃ (1800 ℉) for ore processing, steam generation and other applications

- Provide their own backup by burning almost any locally available fuel to produce power even when storage is depleted, eliminating gensets and reducing fuel costs up to 80%

Get in touch to learn more

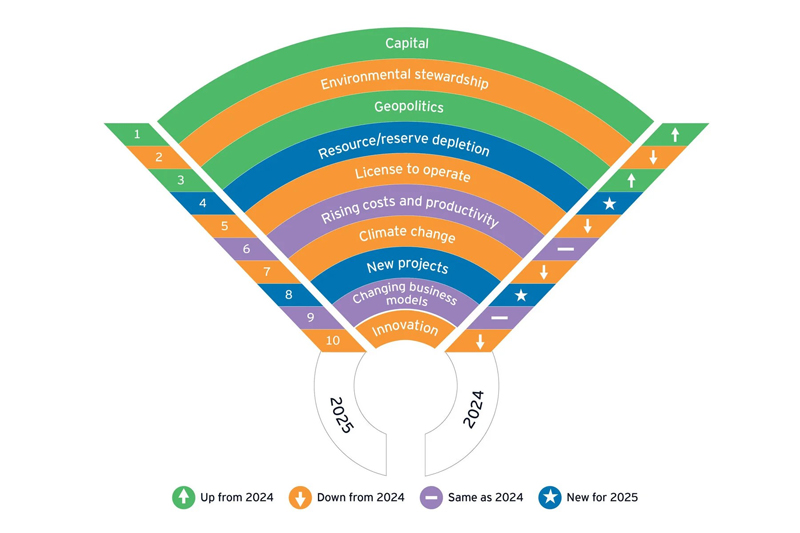

EY: TOP 10 RISKS FOR MINERS

Top 10 risks and opportunities for mining and metals companies in 2025 Credit: EY

Each year, global consultancy EY publishes its survey of the Top 10 risks and opportunities for mining and metals companies and compares the results to the previous year. This year, the survey found:

- Capital is the No. 1 risk, with miners balancing growth and capital discipline to satisfy soaring demand for energy transition minerals.

- Miners have elevated environmental stewardship above a broader approach to ESG, with a laser focus on waste, water and nature positive.

- Resource and reserve depletion has emerged amid soaring demand, rising exploration costs and a lack of new discoveries.

In addition, the energy transition continues to disrupt the sector. The authors say: “Even (people) once opposed to mining now realize that a green energy transition depends upon a greater supply of minerals and metals.”

A summary of the survey report continues: “Before it can meet surging demand, the [mining] sector must first overcome a trifecta of challenges: achieving sustainable mining while managing capital discipline and meeting higher stakeholder expectations. Maximizing value is top of mind for miners, reflected in efforts to reposition portfolios and tap into multiple financing sources to accelerate growth. But a shifting sector also commands miners’ focus on new risks and opportunities. Two additions to the top 10 — resource and reserve depletion, and new projects — highlight rising strategic risks.”

The chart at right shows the ranking of risks for 2025 vs. 2024, based responses from senior mining and metals leaders from organizations around the world.

Download the EY report here.

FORTESCUE, E25 ANNOUNCE 21st CENTURY ADVANCES IN TRANSPORT

Credit: Liebherr

Equipment World reports that Fortescue and Liebherr have teamed to bring battery electric power and autonomous operation to some of the largest mining machines in the world. Separately, Australian manganese miner Element25 is teaming with Scania and services provider Regroup to launch the world’s first fleet of autonomous in-pit mining trucks.

Fortescue and Liebherr revealed Liebherr’s first autonomous, battery-electric, rigid-frame dump truck at the recent Minexpo in Las Vegas, and announced an equipment deal Liebherr says is the largest in its 75-year history.

Per Equipment World, the unveiling of the 240-metric-ton-payload, electric, autonomous hauler also included Liebherr’s new 400-metric-ton electric-drive excavator and plans to develop an electric version of its 70-metric-ton bulldozer.

In a press release, Element 25 said it will collaborate with Regroup & Scania on the world-first fleet of 11 autonomous rigid 8×4 tippers, to transport manganese ore and waste material beginning in 2025. The rollout is intended as a steppingstone to fully electric autonomous ore haulage in line with planned expansion of the E25’s Butcherbird mine. The program will also include the roll-out of a fully battery-electric vehicle (BEV) equipped as a water truck.

FOLLOW & JOIN 247Solar

LinkedIn US, LinkedinEU, Twitter, YouTube

Contact: info@247solar.com