THE COCKTAIL NAPKIN OF ENERGY MATH

“I’m amazed at how many people still don’t realize that LCOE [levelized cost of electricity] is a misleading basis for estimating total system costs to governments, electricity consumers and taxpayers … That’s why I generally ignore it.” So begins an enlightening discussion from Michael Cembalest, Chairman of Market and Investment Strategy for J.P. Morgan Asset & Wealth Management, in his company’s 13th annual energy paper.

Though LCOE is often used as a “bottom-line” number for evaluating the economics of wind and solar projects, Cembalest puts little stock in its usefulness.

“Levelized cost of energy is a distraction,” he says, if you’re trying to understand total system costs of electricity.” This is because, when computed for individual generation or storage technologies, LCOE does not properly take account of:

- the need for backup power, storage and reserve margins to maintain system reliability

- the value of electricity supplied at different times of the day or year

- the need to overbuild wind and solar capacity to meet demand in deeply decarbonized systems

“In other words,” Zembalest says, “LCOE only measures the cost of a marginal MWh of wind or solar power and typically does not include any of these other capital or operating costs.”

Zembalest describes a conversation with Paul Joskow, the Elizabeth and James Killian Professor of Economics Emeritus at MIT. Joscow recounted that LCOE was originally developed to compare costs of dispatchable baseload nuclear and coal plants with the same capacity factors. LCOE, Joscow asserts, is “inappropriate for comparing intermittent generating technologies like wind and solar with dispatchable generation…and also overvalues intermittent generating technologies compared to dispatchable baseload generation.”

Real-life example

To illustrate this point, Zembalest cites a recent example from the United States. The state of Texas has an enormous amount of wind generation, and it has also experienced some extreme weather events. On Dec. 23, 2022, temperatures dropped to 13⁰-28⁰F vs average levels, causing electricity demand to spike while renewable output collapsed. The result was a massive gap that only backup power could fill.

“Natural gas output doubled,” Zembalest says, “but this was not accounted for accounted for in LCOE.” In December 2022, Texas wind capacity factors averaged 32%. “But that doesn’t mean that wind provided steady power at 32% of installed capacity,” he says. In reality, Texas wind generation varied from a low of 5% of capacity to a peak of 70% during the month.

Yet LCOE is calculated the exact same way whether Texas wind capacity factors are 32% for every hour of the month, or if they average 32% but vary from 5%-70%. In the latter scenario, backup thermal power/storage needs, and associated costs, are much higher than in the former. As for energy storage, “low wind conditions lasted for 3 days, in which case,” says Zembalest, “many billions of dollars of 4–6-hour storage would have been needed” to compensate. LCOE, he says, “is the cocktail napkin of energy math.”

Zembalest’s paper is a long but lively read, and also includes an excellent section on the scramble to reshore production and processing of energy minerals. Download it here.

A ROUND-THE-CLOCK CLEAN ALTERNATIVE TO FOSSIL FUELS

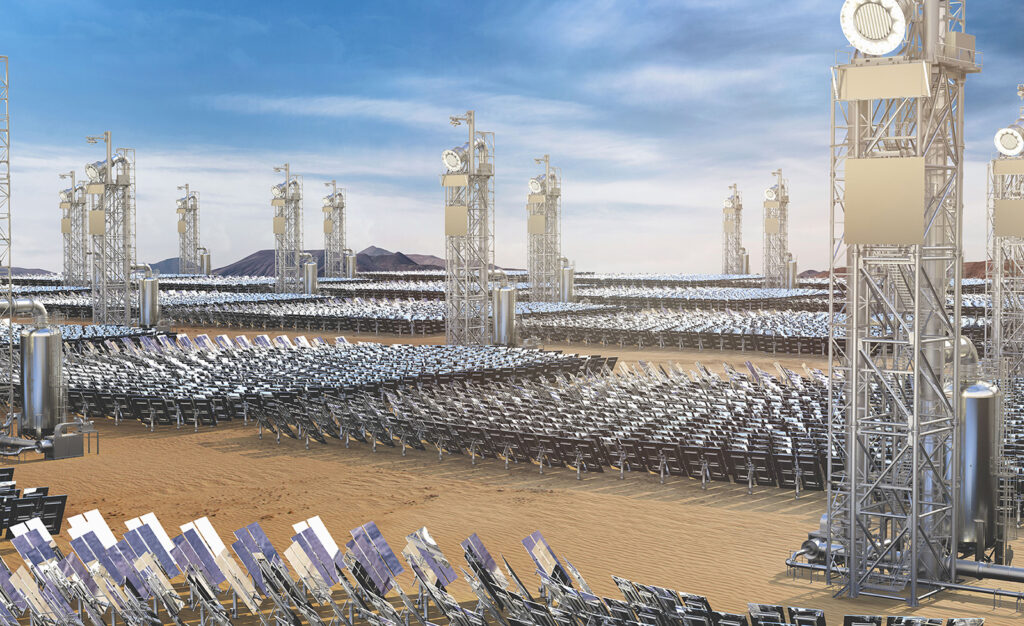

400kWe 247Solar Plants deployed at scale

247Solar Plants™ bridge the gap between conventional wind and solar and the need for round-the-clock utility power and industrial-grade heat. 247Solar Plants store the sun’s energy as heat instead of electricity, for 9 hours or more, at much less than the cost of batteries. No generators are required, and 247Solar’s turbines can also burn a variety of fuels, including hydrogen, to ensure 24/7/365 dispatchability.

Extensive Applications

On-grid or off-grid, 247Solar Plants offer a 24/7 alternative to fossil fuels for a broad range of applications:

- CHP: 24/7 low-carbon Combined Heat & Power for industry

- Ultra Heat: Each 247Solar Plant can provide up to 1,500,000 Btu/hr. of heat at temperatures up 1000℃/1800℉ for industrial processes such as cement, glass, steel making, or minerals processing

- Microgrids: Always-on, emissions-free electricity and heat for islands, mines, communities, facilities

- 24/7 baseload power: 24/7 solar electricity, especially for emerging economies

- Green Hydrogen: 24/7 solar electricity and heat to power electrolysis around the clock

- Green Desalination: 24/7 solar electricity and heat to purify water around the clock

BLACKROCK: BARRIERS TO THE GLOBAL ENERGY TRANSITION

Count on the leader of the world’s largest private equity fund to provide a realistic appraisal of the prospects for a global energy transition. Larry Fink, founder and CEO of BlackRock recently spoke with Jason Bordoff, founding director at the Center for Global Energy Policy at Columbia’s School of International and Public Affairs in a wide-ranging and provocative interview.

Count on the leader of the world’s largest private equity fund to provide a realistic appraisal of the prospects for a global energy transition. Larry Fink, founder and CEO of BlackRock recently spoke with Jason Bordoff, founding director at the Center for Global Energy Policy at Columbia’s School of International and Public Affairs in a wide-ranging and provocative interview.

As reported by Rod Walton in EnergyTech, Fink says, “We’re really not being truthful to ourselves.” Fink acknowledges that while decarbonizing the economy could represent “the greatest investment opportunity of a lifetime,” conditions are tougher now with high inflation, interest hikes and geopolitical conflict creating headwinds.

He recognizes that the worldwide capital investment required is huge — on the order of $100 trillion by 2050, according to Walton. But, “even if that capital is deployed efficiently in developed economies, what about the rest of the world where the need for affordable electricity is even greater and the means are harder to come by … What good is all of this energy transitioning if China, India, southeast Asia, South America and Africa are still burning fossil fuels because that is the quickest and most affordable way to heat and electrify homes and businesses.”

The challenge is twofold, Fink says. First, “No one has come up with a proper solution on how we bring the emerging world forward … If we want to be faithful to [the goal of global decarbonization] we need emerging countries to come along with us.” The only way to do this, he say, is to create better technology to bring down the cost.

Also, as Walton put it, “The customer in the energy sector may want clean energy but he or she also wants abundant, cheaper energy maybe even more. And we cannot just wish away the bad old hydrocarbons. They are a bridge at the very least, and highly favored among a sizable part of the population which doesn’t align with energy transition orthodoxy.”

“We need to find ways of working together instead of talking around each other and over each other,” Fink says. “I’m an optimist on decarbonization, but … we need to make sure we include (resource) adequacy in energy policy.”

Read more.

EU APPROVES WORLDS FIRST CARBON TAX ON IMPORTS

The European Union is continuing its aggressive action on climate change with the approval of first of-its-kind legislation to tax imports based on the greenhouse gases emitted to make them. The Wall Street Journal reports that the new tariffs, called Carbon Border Adjustments, “aim to push economies around the world to put a price on carbon-dioxide emissions while shielding the EU’s manufacturers from countries that aren’t regulating emissions as strictly, or at all.”

The European Union is continuing its aggressive action on climate change with the approval of first of-its-kind legislation to tax imports based on the greenhouse gases emitted to make them. The Wall Street Journal reports that the new tariffs, called Carbon Border Adjustments, “aim to push economies around the world to put a price on carbon-dioxide emissions while shielding the EU’s manufacturers from countries that aren’t regulating emissions as strictly, or at all.”

The European Commission website states, “The EU’s Carbon Border Adjustment Mechanism (CBAM) is our landmark tool to put a fair price on the carbon emitted during the production of carbon intensive goods that are entering the EU, and to encourage cleaner industrial production in non-EU countries … By confirming that a price has been paid for the embedded carbon emissions generated in the production of certain goods imported into the EU, the CBAM will ensure the carbon price of imports is equivalent to the carbon price of domestic production, and that the EU’s climate objectives are not undermined.”

Read the EU announcement here.

FOLLOW & JOIN 247Solar

LinkedIn US, LinkedinEU, Twitter, YouTube

Contact: info@247solar.com