NEW APPROACHES CAN AVOID GREEN METALS CRUNCH

Vlad Chețan/Pexels

Miners should “Keep digging,” says The Economist. But a deeper read of a recent article suggests that digging alone won’t avoid what the newspaper calls a potential 6.5bn-tonne demand crunch for green metals.

The authors cite projections from the Energy Transitions Commission that hitting global emissions targets by 2050 will require “15 times today’s wind power, 25 times more solar, a tripling of the grid’s size and a 60-fold increase in the fleet of electric vehicles.” This means that “by 2030 copper and nickel demand could rise by 50-70%, cobalt and neodymium by 150%, and graphite and lithium six- to seven-fold.”

Of course, miners are exploring new deposits in new locations. This is to leave no stone un

turned in the search for additional resources, and also to diversify supply chains away from geopolitically risky suppliers. Digging new mines could solve the demand problem entirely in the long run, the authors believe, but these efforts are of limited benefit in the short and medium term. This is because digging new mines takes time and faces obstacles along the way.

“Digging new mines takes ages,” the authors write, “from four to seven years for lithium to an average of 17 for copper—and delays have been worsened by a paucity of permits.” Meanwhile, the quality of ores mined in stable countries is falling, forcing miners to look to “dicier locations.”

Quick wins

In the near term, they write, “Quick wins could come from reusing more material,” such as aluminium, copper and nickel. “All are widely recycled, [and] higher prices will motivate spending in a fragmented industry.” More metal also could come from restarting mines, the authors suggest, but not many are idle. Instead, “The greatest hope lies in technologies that squeeze supply from deposits.” For example, “New firms are developing chemical processes that extract copper from ores with low metal content, making waste exploitable. Using the tech at scale could yield an extra 1m tonnes of copper a year without much cost … Meanwhile, in Indonesia, the world’s largest nickel producer, miners are using ‘high-pressure acid leaching’ to turn low-grade ores into material fit for electric cars.”

These initiatives face obstacles as well, the first of which is funding. The Economist cites a McKinsey study that estimates that “to fill supply gaps by 2030 annual capital expenditure in mining will have to double to $300bn.” The good news is that investment by big miners is rising and customers are entering the fray too. “General Motors, a carmaker, is investing $650m in Lithium Americas, a miner in Nevada. CATL, a Chinese battery firm, is spending billions to source cobalt and lithium. Since the start of the year pension and sovereign funds have invested $3.7bn in private mining assets … And about $21bn in capital raised by private-equity firms since 2010 is also chasing deals.”

Overall, the authors identify three “levers” that can be used to address the gaps between supply and demand for green metals between today and 2050. “First, producers may extract more supply from existing sources … Second, firms may open new mines, which could solve the problem entirely but will take time. The limitations of these two levers make a third the most important, at least over the next decade: finding ways to change what customers want.” The third is a complex topic and one over which miners have little control. In the meantime, miners must keep digging, but also keep innovating.

Read the full Economist article here.

A ROUND-THE-CLOCK CLEAN ALTERNATIVE TO FOSSIL FUELS

Modular, scalable 247Solar Plants

Achieving high levels of renewable energy is particularly challenging for off-grid mines in remote locations because intermittent PV or wind with costly batteries still require dirty, expensive diesel for backup. Many mines also require high-grade heat for on-site processing and other uses. 247Solar offers the only renewable energy technologies that:

- Integrate seamlessly with PV or wind to provide 24/7 dispatchable baseload power

- Provide industrial grade heat up to 970 ℃ (1800 ℉) for ore processing, steam generation and other applications

- Provide their own backup by burning almost any locally available fuel to produce power even when storage is depleted, eliminating gensets and reducing fuel costs up to 80%

Get in touch to learn more.

COPPER ADDED TO U.S. CRITICAL MINERALS LIST

Source: U.S. DOE

As reported by Mining Weekly, a new Critical Minerals Assessment from the U.S. Department of Energy (DOE) for the first time includes copper on its list of materials critical to the energy transition. According to a press release, 2023 Critical Materials Assessment focuses on key materials with high risk of supply disruption that are integral to clean energy technologies.

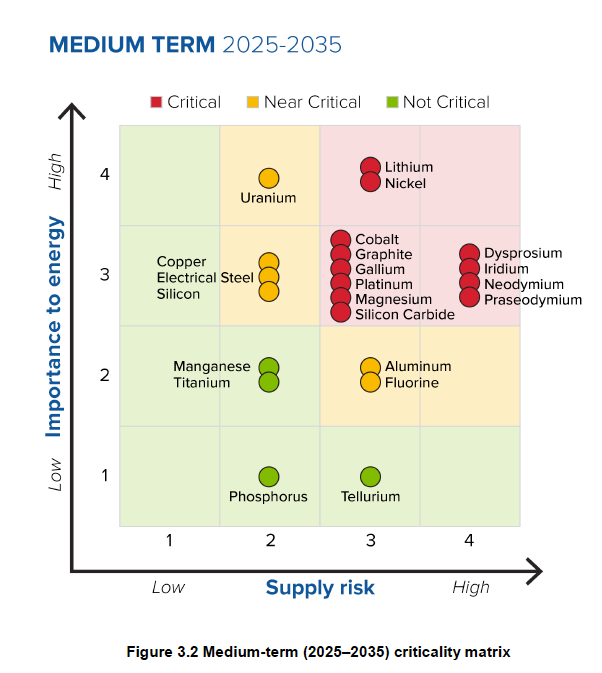

Per the Assessment, the list of those both most important and most exposed to supply risk includes aluminum, cobalt, copper, dysprosium, electrical steel, fluorine, gallium, iridium, lithium, magnesium, natural graphite, neodymium, nickel, platinum, praseodymium, terbium, silicon, and silicon carbide. See chart.

As the Economist article excerpted above reports, copper demand is expected to rise by 50-70% by 2030, and new copper mines take an average of 17 years to come on line. This puts the copper supply at critical risk in the medium term, from 2025 to 2035.

Quoted in Mining Weekly, Copper Development Association (CDA) president and CEO Andrew Kireta says, “[This] is the first time a US federal agency is following the lead of the EU, Canada, Japan, India, China and others by characterising copper as critical.”

Read more here.

BHP TO ELECTRIFY FLEETS IN CHILE AND ELSEWHERE

SMS Equipment

At a recent investor briefing, BHP announced plans to electrify its truck fleets as part of its commitment to reduce operational emissions by at least 30% by 2030 compared to 2020 levels and achieve net-zero emissions by 2050.

International Mining reports that, starting in Chile, BHP plans to implement trolley assist for fleet decarbonization, starting with diesel trolley and transitioning to battery trolley, beginning at the company’s Escondida mine in 2028 and at the Spence mine in 2029.

During the briefing, Alejandro Tapia, Planning and Technical VP, Minerals Americas revealed that BHP has committed to trolley assist to advance fleet decarbonisation in Chile – starting with diesel trolley then advancing to battery trolley. IM quotes Tapia as saying, “We have thought deeply about the approach here … At the second stage, the trolley will not only power the electric drive, but it will also charge the batteries while the trucks are operating, so reducing the need to stop for static charging.”

Overall, BHP expects the Chile initiative abate around 300 million litres of diesel fuel consumption annually, or about 80% of the mines’ Scope 1 (direct) emissions.

Read more.

FOLLOW & JOIN 247Solar

LinkedIn US, LinkedinEU, Twitter, YouTube

Contact: info@247solar.com