THE ENERGY TRANSITION IS A COMMODITIES TRANSITION

Two recent reports highlight the coming upheaval in metals and minerals markets as the energy transition upsets stable relationships between supply and demand. Global consultancy McKinsey and Company projects that, “For some commodities, such as copper, lithium, and boron, supply will fall well short of demand by 2030.” Beyond this, “Inadequate capital expenditures and delays in bringing new capacity online are likely to contribute to price spikes and to inject uncertainty and volatility into the markets. Meanwhile, rising protectionism, geopolitical disruptions, and concentrated supply chains could disrupt trade flows and give rise to regional markets.”

Two recent reports highlight the coming upheaval in metals and minerals markets as the energy transition upsets stable relationships between supply and demand. Global consultancy McKinsey and Company projects that, “For some commodities, such as copper, lithium, and boron, supply will fall well short of demand by 2030.” Beyond this, “Inadequate capital expenditures and delays in bringing new capacity online are likely to contribute to price spikes and to inject uncertainty and volatility into the markets. Meanwhile, rising protectionism, geopolitical disruptions, and concentrated supply chains could disrupt trade flows and give rise to regional markets.”

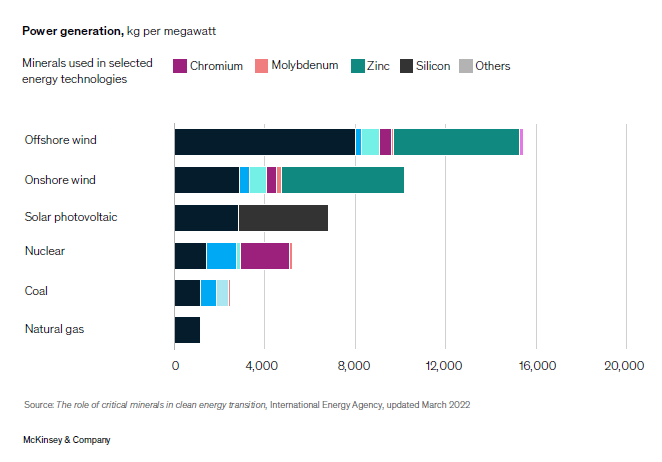

McKinsey says that transition minerals — those that support clean energy technologies — will be in greater demand because lower-carbon technologies typically require more of these materials than conventional energy sources (see chart). The authors project that by 2030, “battery EVs and the associated charging infrastructure will consume upwards of 50 percent of rare earth elements, 55 percent of cobalt, and 36 percent of nickel.”

At the same time, McKinsey sees obstacles to creating new capacity. “Funding exploration projects to identify previously unknown reserves will be critical to the market’s evolution. But at a time when huge levels of investment will be needed, the landscape has become more challenging. Rising interest rates and decreased availability of financing means producers will have to pay a premium to secure funding.” And some producers continue to take a short-term view. “In the face of rising long-term demand, commodities players have trimmed capital expenditures … Rather than allocating funds for capital expenditures, companies are putting money into dividends and stock buybacks.”

A double bind

These trends create a double bind. According to the IEA’s Critical Minerals Market Review, “The affordability and speed of energy transitions will be heavily influenced by the availability of critical mineral supplies.” Fortunately, the IEA notes that, “Countries are seeking to diversify mineral supplies with a wave of new policies. There is growing recognition that policy interventions are needed to ensure adequate and sustainable mineral supplies.” However, “Many of these interventions have implications for trade and investment, and some have included restrictions on import or export. Among resource-rich countries, Indonesia, Namibia and Zimbabwe have introduced measures to ban the export of unprocessed mineral ore. Globally, export restrictions on critical raw materials have seen a fivefold increase since 2009.”

The IEA asserts that three layers of supply-side challenges need to be addressed to ensure rapid and secure energy transitions. They are:

- Whether future supplies can keep up with the rapid pace of demand growth in climate-driven scenarios;

- Whether those supplies can come from diversified sources; and

- Whether those volumes can be supplied from clean and responsible sources.

Ultimately, the move from fossil fuels to low carbon energy sources will create opportunities. Says the IEA, “energy transition minerals, which used to be a small segment of the market, are now moving to centre stage in the mining and metals industry. This brings new revenue opportunities for the industry, creates jobs for the society, and in some cases helps diversify coal-dependent economies.”

McKinsey concludes, “The energy transition will drive an unprecedented growth in demand for metals and minerals that underpin key transition technologies. However, supply faces structural constraints to bring on new investment, to scale substitutes, and to navigate concentrated supply-chain bottlenecks, resulting in a long-term deficit in critical commodities.”

Read more from McKinsey and the IEA here

A ROUND-THE-CLOCK CLEAN ALTERNATIVE TO FOSSIL FUELS

An array of 247Solar HeatStorE long-duration thermal batteries

Achieving high levels of renewable energy is particularly challenging for off-grid mines in remote locations because intermittent PV or wind with costly batteries still require dirty, expensive diesel for backup. Many mines also require high-grade heat for on-site processing and other uses. 247Solar offers the only renewable energy technologies that:

- Integrate seamlessly with PV or wind to provide 24/7 dispatchable baseload power

- Provide industrial grade heat up to 970 ℃ (1800 ℉) for ore processing, steam generation and other applications

- Provide their own backup by burning almost any locally available fuel to produce power even when storage is depleted, eliminating gensets and reducing fuel costs up to 80%

Get in touch to learn more

MINERS SLOWLY MENDING MIDDLING REPUTATION

Red Ivory/Shutterstock

The mining, metals and minerals (MMM) sector is slowly improving its reputation among important external stakeholders but still has work to do. According to Caliber, a Copenhagen-based stakeholder intelligence company, the MMM industry has an average reputation, on par with the automotive and chemicals sectors and better perceived than the energy, banking and telecoms sectors.

Caliber’s 2023 Mining, Metals and Minerals Global Reputation Report gives the MMM sector has a Trust & Like Score (TLS) off 66 out of 100. Merely middling, but an improvement over five years prior. “On average,” Caliber reports, “MMM companies are perceived most favorably for their offering, ability to innovate, and leadership. Conversely, they are perceived less favorably for their impact on the planet, their relatability, and how ethically they conduct business.”

Interestingly, most survey respondents (67%) cited efforts to fight climate change as at least as important as ensuring a steady supply of raw materials needed for the green energy transition, seemingly ignoring the clear connection between the two. Søren Holm, senior advisor at Caliber quoted in MINING.com said,“[W]hat surprised us was the priority placed by respondents on the industry’s efforts to fight climate change over the industry’s ability to secure a steady supply of raw materials.”

When asked what the mining industry could do to improve its reputation, Holm said “showing a reduction in CO2 emissions, having no negative impact on the local population in connection with mining sites and extraction of materials, and showing how the industry invests in better technology for more efficient extraction are top of mind … By communicating publicly and establishing clearer positions on topics of public interest, companies can take more control of how their reputations are shaped.”

Read more here.

FORTESCUE ON TRACK FOR DECARBONIZATION GOALS

T. Schneider/Shutterstock

The headline in Australian Mining read, “Fortescue not proceeding with Pilbara energy hub.” We have always seen Fortescue as the most forward-looking of mining companies regarding climate change, so at first, we were disappointed. Reading further, we realized this was actually good news.

The facility, which was expected to include up to 340 wind turbines, a solar farm and a battery energy storage system, was intended to support Fortescue’s net-zero goals. But the article quotes Fortescue chief executive officer Dino Otranto as saying that plans for the hub were redundant.

“From the decarbonisation agenda we have for metals,” Otranto said, “we have a clear line of sight of all the land we need. In fact, we have got land we have already approved, basically old parts of our mining lease that we are building on.”

The article goes on to quote Fortescue’s non-executive director Larry Marshall saying in October that the company is still on track to achieving real zero terrestrial Scope 1 and 2 emissions across its iron ore operations by 2030. Marshal’s remarks coincided with Fortescue’s public release of its comprehensive Climate Transition Plan.

Read more.

FOLLOW & JOIN 247Solar

LinkedIn US, LinkedinEU, Twitter, YouTube

Contact: info@247solar.com