247SOLAR MICROGRIDS FOR MINES

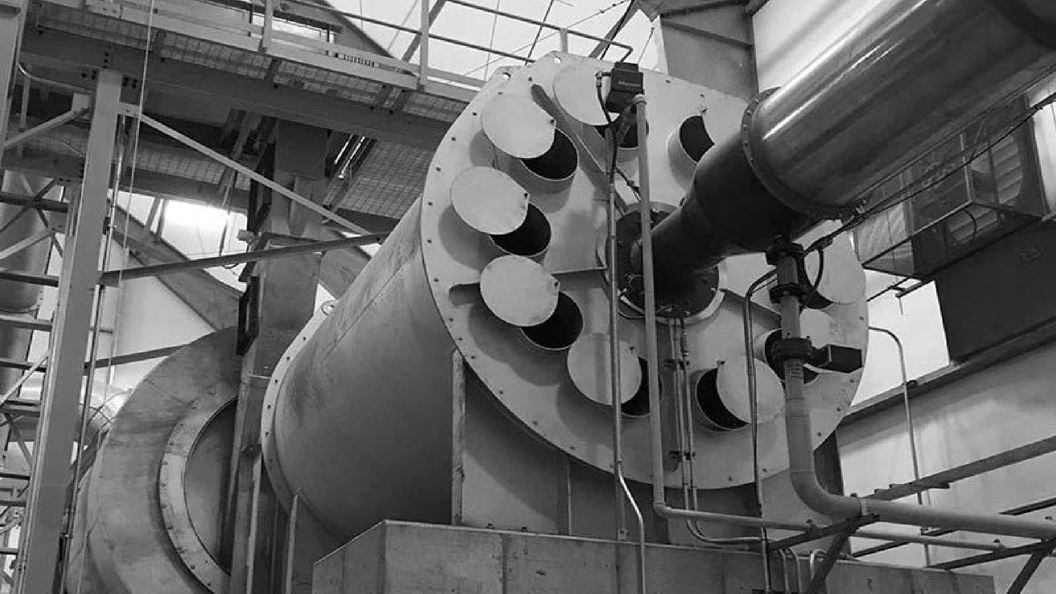

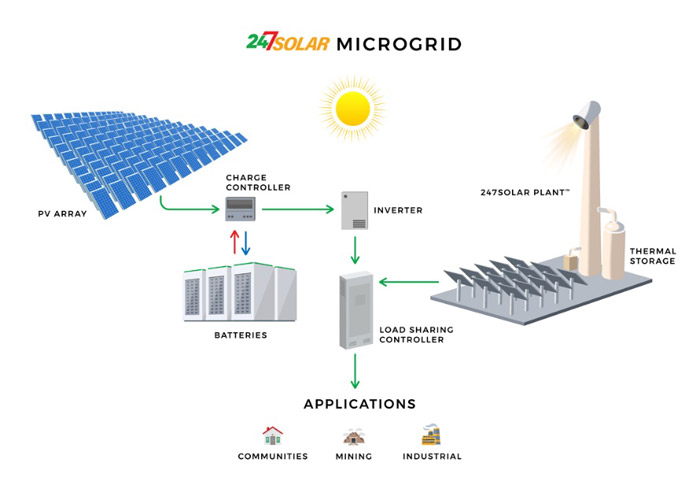

Mines need power around the clock, and at best, PV and batteries can operate 30-40% of the time. Beyond that, most mines are burning diesel. With 247Solar Microgrids, you can be running on renewable power 80-90% of the time, saving fuel and dramatically lowering emissions.

PWC: ESG NOW A STRATEGIC IMPERATIVE FOR MINERS

Mine 2021 Report Highlights Compelling Mining Industry Opportunities

Just released, global consultancy PwC’s 18th annual report on the mining industry looks at strong financial and operational performance from the world’s top 40 mining companies and projects a future ripe with opportunities. The authors see an industry that has weathered the worst of the COVID-19 economic crisis and emerged in excellent shape. Per the report, net profit in 2020 was up 15%, cash on hand rose 40%, and market capitalization increased by nearly two-thirds compared to 2019. And they forecast things to get even better, as they expect record-high revenue and EBITDA levels and the second-highest net profit levels in the report’s history for 2021.

To the authors, this means that mining companies have never been in a stronger position “to make a big, bold pivot towards the future.” They continue, “The future is already visible today: the world is in the midst of an era-defining transition to a low-carbon, sustainable economy.”

ESG pays

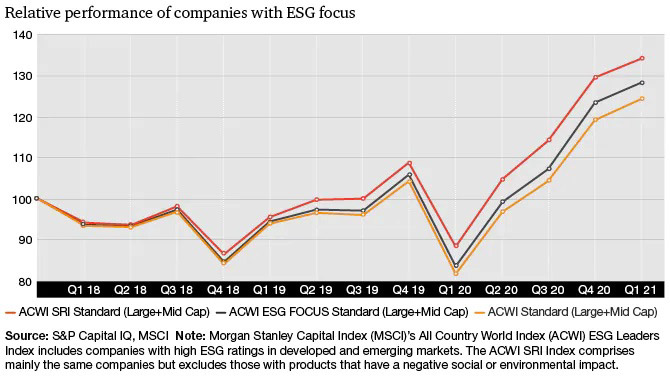

The key, the report suggests, is making environmental, social and governance (ESG) issues the core of organizational strategy. An article in Australian Mining quotes PwC global mining leader Paul Bendall: “This isn’t just about doing the right thing and appeasing shareholders.” Performance results suggest that a focus on ESG is now paying real dividends. The report found that companies that rated higher on ESG outperformed the broader market during the peak of the pandemic, as well as in the longer term. The authors also note that “investors are increasingly drawn to companies that actively embrace ESG policies.” Thus, “beyond their potential financial performance returns, ESG considerations are becoming fundamental to deal success.”

Multiple opportunities

The report sees two-fold long-term value creation opportunities for mining companies that “bake ESG into their core operating strategies.” These include not only improved access to capital, but also the opportunity to ride the wave of an ever-increasing demand for low-carbon products.

According to the International Energy Agency, the energy sector’s need for critical minerals that are essential for clean energy technologies could increase by as much as six times by 2040. The authors assert that “while miners will likely continue to shift away from thermal coal, they need to explore replacing that revenue stream with ESG-oriented businesses.”

The report also offers a caveat. “Although many (miners) understand the importance of ESG, some still see it as just another box to tick.” But to the authors, “ESG represents one of the mining industry’s most significant opportunities for long-term value creation, building trust and sustainable growth … Miners need to demonstrate that they not only understand the risks and opportunities of ESG but are committed to addressing them in everything they do.”

PwC’s Bendall says, “Just as the world pivots to a more sustainable future reliant on a lower-carbon economy, the miners have a chance to think strategically towards a decarbonization future and ESG agenda, and reap the long- Read the Executive Summary and download the full PwC report here.

FOLLOW & JOIN 247Solar

LinkedIn, Twitter, YouTube, Whatsapp

Contact: info@247solar.com