RECRUITING CHALLENGES CLOUD THE FUTURE FOR MINERS

Bloomberg

Bloomberg reports that recruiting challenges for miners are making it hard to hire new engineers and geologists, even as demand is increasing for critical strategic minerals. Authors Tiffany Tsoi and Mark Burton write: “Digging up the metals that go into power grids and electric cars is crucial to the energy transition. While the mining industry has plenty of reserves to tap, it faces a worrying shortage of young workers needed to get materials out of the ground.”

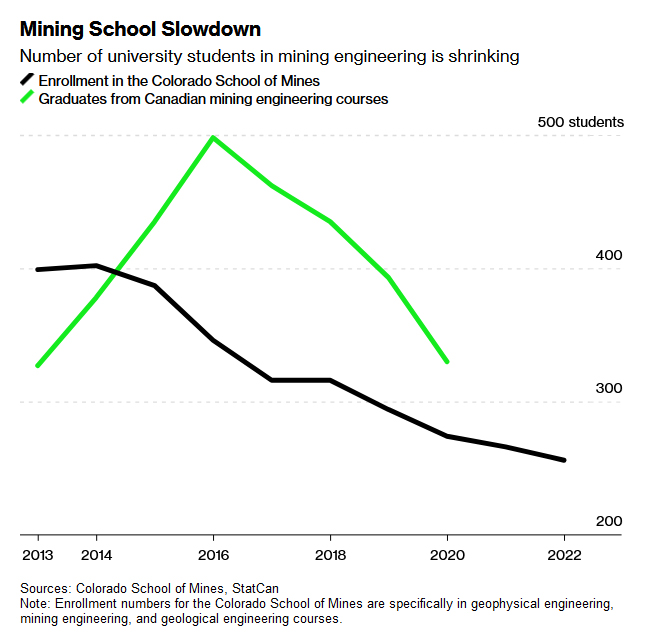

The decline in enrollment at major mining schools is significant. The authors report that enrollment in undergraduate mining, geophysical and geological engineering degree courses at the Colorado School of Mines was down about 35% last year compared to a decade ago. The same is true in Canada, where mining and mineral engineering graduates dropped by a third between 2016 and 2020. At the UK’s Camborne School of Mines, the number of students earning degrees from its undergraduate mining engineering course has fallen to the point where it has halted new intakes and begun focusing on programs for current mining employees.

This is happening as existing mining workforces are aging. For example, roughly 80% of the 1,250 mining engineers registered with the UK’s Engineering Council are over 50, and 40% are at least 60, according to Rhys Morgan of the Royal Academy of Engineering, who was interviewed by the authors.

Several causes

Several factors are at play. Tsoi and Burton explain that “Fewer students want to be geologists or engineers, partly due to mining’s negative image regarding pollution, human rights and gender equality.” But also, improved efficiency means that major players are producing more output than before with fewer workers. The authors suggest that AI and automation may further reduce the sector’s reliance on traditional skilled labor and shift the kinds of roles that are needed. They note that Rio Tinto’s tech graduate roles rose 15% this year.

To compensate, mining companies are being forced to recruit from outside the traditional university talent pool, such as through apprenticeship programs and internal training. But there’s also a silver lining for young people who are considering mining careers. Tsoi & Burton note that the drop in mining graduates means that those who do choose to go into the industry have a chance of a lucrative career.

They quote a student at the Camborne School of Mines who says, “I was bluntly told that if I have a master’s at CSM, I could walk into a job.” He describes how he’s found some people are surprised at his choice, given the stigma surrounding mining. That’s ironic he says, “because the entire infrastructure of technology is built on metal.” And of course, the extraction of so-called transition minerals is critical to achieving the world’s decarbonization imperatives.

Read more here.

A ROUND-THE-CLOCK CLEAN ALTERNATIVE TO FOSSIL FUELS

An array of 247Solar HeatStorE long-duration thermal batteries

Achieving high levels of renewable energy is particularly challenging for off-grid mines in remote locations because intermittent PV or wind with costly batteries still require dirty, expensive diesel for backup. Many mines also require high-grade heat for on-site processing and other uses. 247Solar offers the only renewable energy technologies that:

- Integrate seamlessly with PV or wind to provide 24/7 dispatchable baseload power

- Provide industrial grade heat up to 970 ℃ (1800 ℉) for ore processing, steam generation and other applications

- Provide their own backup by burning almost any locally available fuel to produce power even when storage is depleted, eliminating gensets and reducing fuel costs up to 80%

Get in touch to learn more

CHINA MAKES NEW STRATEGIC MINERALS MOVES

Butterfly austral/Wikimedia Commons

Two articles provided by Mining.com highlight new moves by China in the global chess game around strategic mineral supplies. Following moves in July to restrict exports of gallium and germanium, Reuters reported that China has announced curbs on graphite exports, specifically targeting forms of graphite used in EV batteries.

According to Reuters, graphite is the largest EV battery component by weight. China is the dominant player in the global supply of both natural graphite and synthetic graphite, accounting for around two-thirds of all natural graphite production and supplying around 98% of the world’s synthetic graphite anodes.

The moves are in the response to sanctions by western governments that restrict sales of high-tech semiconductors to China. The Biden administration had just announced tightened restrictions on the flow of advanced artificial intelligence chips to China, and China responded in kind.

South American Expansion

Separately, Bloomberg reported that China has made new investments in South America’s lithium triangle, home to more than half of the world’s known lithium reserves. In one move, Chile unveiled a deal that gives China’s Tsingshan Holding Group preferential lithium prices for a project to make value-added products in the South American nation.

Bloomberg also noted that Tsingshan had agreed to invest $233 million in a plant in Chile’s Antofagasta region to produce as much as 120,000 tons a year of lithium iron phosphate, and that Yongqing Technology, Tsingshan’s new energy unit, would source feedstock for its plant from Chile’s biggest lithium producer, SQM, at preferential prices through 2030.

Taken together, these events continue a global tug of war between China and the US. Says Bloomberg, “Washington is pushing EV makers globally to produce more vehicles in North America and secure the key minerals for them outside of (China). But while Chile and Argentina are keen to participate, they continue to woo Chinese investors.”

Read the graphite and lithium articles here.

WESTERN AUSTRALIA MINERS TO COLLABORATE ON WORLD’S LARGEST MICROGRID

iStock

The remote Pilbara region in the north-west of Western Australia is rich in minerals, but the individual companies that mine it typically have done their own thing. Writing in Renew Economy, Gilles Parkinson observes that “they have built their own mines, their own roads, their own towns, their own rail lines (sometimes running next to each other) and – in some cases – their own electricity grids.”

Now, mining giants BHP, Rio Tinto, Fortescue Metals, and Roy Hill, plus oil and gas majors and local energy groups have agreed to work together work together and share their grids to cut costs and lower emissions by facilitating the construction of wind, solar and storage.

Parkinson writes, “The transformation of Western Australia from a state that, a decade ago, opened the country’s first large-scale solar farm, and then promptly declared its hope to never open another one, to a state that hosts what is effectively the world’s biggest micro-grid and is preparing for the exit of coal, is quite remarkable.”

FOLLOW & JOIN 247Solar

LinkedIn US, LinkedinEU, Twitter, YouTube

Contact: info@247solar.com