THE IRRELEVANCE OF LCOE FOR EVALUATING WIND AND SOLAR

“I’m amazed at how many people still don’t realize that LCOE [levelized cost of electricity] is a misleading basis for estimating total system costs to governments, electricity consumers and taxpayers … That’s why I generally ignore it.” So begins an enlightening discussion from Michael Cembalest, Chairman of Market and Investment Strategy for J.P. Morgan Asset & Wealth Management, in his company’s 13th annual energy paper.

Though LCOE is often used as a “bottom-line” number for evaluating the economics of wind and solar projects, Cembalest puts little stock in its usefulness.

“Levelized cost of energy is a distraction,” he says, if you’re trying to understand total system costs of electricity.” This is because, when computed for individual generation or storage technologies, LCOE does not properly take account of:

- the need for backup power, storage and reserve margins to maintain system reliability

- the value of electricity supplied at different times of the day or year

- the need to overbuild wind and solar capacity to meet demand in deeply decarbonized systems

“In other words,” Zembalest says, “LCOE only measures the cost of a marginal MWh of wind or solar power and typically does not include any of these other capital or operating costs.”

Zembalest describes a conversation with Paul Joskow, the Elizabeth and James Killian Professor of Economics Emeritus at MIT. Joscow recounted that LCOE was originally developed to compare costs of dispatchable baseload nuclear and coal plants with the same capacity factors. LCOE, Joscow asserts, is “inappropriate for comparing intermittent generating technologies like wind and solar with dispatchable generation…and also overvalues intermittent generating technologies compared to dispatchable baseload generation.”

Real-life example

To illustrate this point, Zembalest cites a recent example from the United States. The state of Texas has an enormous amount of wind generation, and it has also experienced some extreme weather events. On Dec. 23, 2022, temperatures dropped to 13⁰-28⁰F vs average levels, causing electricity demand to spike while renewable output collapsed. The result was a massive gap that only backup power could fill.

“Natural gas output doubled,” Zembalest says, “but this was not accounted for accounted for in LCOE.” In December 2022, Texas wind capacity factors averaged 32%. “But that doesn’t mean that wind provided steady power at 32% of installed capacity,” he says. In reality, Texas wind generation varied from a low of 5% of capacity to a peak of 70% during the month.

Yet LCOE is calculated the exact same way whether Texas wind capacity factors are 32% for every hour of the month, or if they average 32% but vary from 5%-70%. In the latter scenario, backup thermal power/storage needs, and associated costs, are much higher than in the former. As for energy storage, “low wind conditions lasted for 3 days, in which case,” says Zembalest, “many billions of dollars of 4–6-hour storage would have been needed” to compensate. LCOE, he says, “is the cocktail napkin of energy math.”

Zembalest’s paper is a long but lively read, and also includes an excellent section on the scramble to reshore production and processing of energy minerals. Download it here.

A ROUND-THE-CLOCK CLEAN ALTERNATIVE TO FOSSIL FUELS

An array of 247Solar HeatStorE long-duration thermal batteries

Achieving high levels of renewable energy is particularly challenging for off-grid mines in remote locations because intermittent PV or wind with costly batteries still require dirty, expensive diesel for backup. Many mines also require high-grade heat for on-site processing and other uses. 247Solar offers the only renewable energy technologies that:

- Integrate seamlessly with PV or wind to provide 24/7 dispatchable baseload power

- Provide industrial grade heat up to 970 ℃ (1800 ℉) for ore processing, steam generation and other applications

- Provide their own backup by burning almost any locally available fuel to produce power even when storage is depleted, eliminating gensets and reducing fuel costs up to 80%

Get in touch to learn more

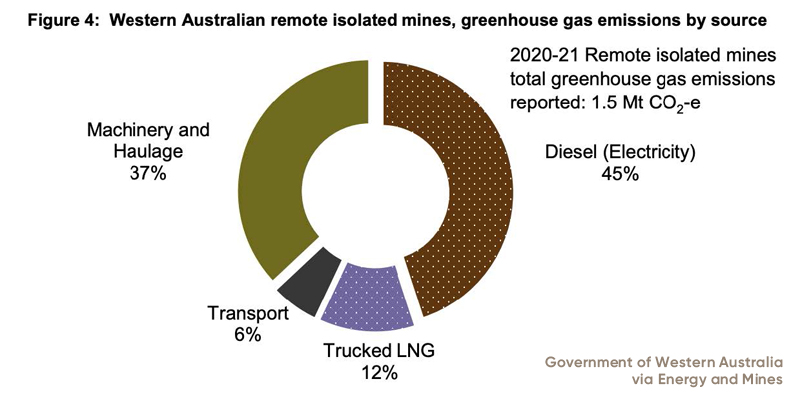

WESTERN AUSTRALIA SHOWS THE WAY TOWARD MINE DECARBONIZATION

A recent article in Energy and Mines describes how Western Australia is on the cutting edge of the transition to renewable power in mining. The article begins: “Western Australia (WA) mines are some of the most ambitious in the world when it comes to renewable energy adoption.” This is helped by the abundance of solar and wind power in the region, which makes renewable power cheaper than fossil fuels in many cases. But also, roughly a third of WA mines are not connected to any electricity grid or gas pipeline. “These off-grid mines,” E&M says, “are forced to bring diesel or gas to their sites by truck, adding to the cost of power and to the appeal of on-site renewables.”

A recent article in Energy and Mines describes how Western Australia is on the cutting edge of the transition to renewable power in mining. The article begins: “Western Australia (WA) mines are some of the most ambitious in the world when it comes to renewable energy adoption.” This is helped by the abundance of solar and wind power in the region, which makes renewable power cheaper than fossil fuels in many cases. But also, roughly a third of WA mines are not connected to any electricity grid or gas pipeline. “These off-grid mines,” E&M says, “are forced to bring diesel or gas to their sites by truck, adding to the cost of power and to the appeal of on-site renewables.”

The push toward greater renewables adoption is being driven by the fact that WA supplies most of the minerals used for wind and solar generation, batteries and electric vehicles. The state produces substantial amounts of lithium, nickel, copper, rare earth, cobalt and zinc — critical minerals for the net zero transition whose value is rising tremendously. But as E&M points out, “special attention must be paid to their extraction, to ensure that greenhouse gas (GHG) emissions at the source don’t counteract the benefits of transitioning to renewables and electric vehicles.” The article quotes a spokesperson for the WA government who says, “With this opportunity also comes a challenge, in ensuring new and increased demand for these minerals meets rising environmental, social and governance (ESG) expectations and does not negatively impact on the competitiveness of the mining sector.”

E&M gives the example of Gold Fields’ Agnew mine to show how WA miners are leading the way. “In 2019, [the] Agnew site was the first gold mine in the state to commission a hybrid plant including solar, wind and storage … Today, Agnew gets 57% of its power from renewables on average, and up to 85% in optimal conditions.” Gold Fields plans to increase the average to about 75% by adding more solar capacity in the near future. The article quotes Stuart Matthews, Gold Fields Executive Vice President, Australasia: “In seven- or eight-years’ time, we will own this outright after we repay capital back to the people that built it for us, and then our cost base drops off a cliff.” A little-appreciated fact about solar and wind is that, once you’ve paid off the investment in capture technologies, the ongoing supply of resources is abundant and free.

Access the Energy and Mines article here.

CHILE’S LITHIUM NATIONALIZATION SHINES LIGHT ON EMERGING TECH

IStock

Reuters reports that Chilean President Gabriel Boric’s plan to nationalize his country’s immense lithium industry is focused on emerging technologies aimed at revolutionizing how the metal is produced for the electric vehicle industry.

According to Reuters, Boric has said that a new state-owned company would work to slash the environmental impacts of lithium production by shifting away from evaporation ponds, traditionally used to remove the metal from brine, in favor of direct lithium extraction (DLE).

DLE technologies are designed to extract the metal from salty brines in Chile’s Atacama Desert and elsewhere in the world using filters, membranes, ceramic beads or other equipment that can typically be housed in a small warehouse.

Though most DLE technologies are unproven at commercial scale, they present an attractive alternative to open-pit mines and evaporation ponds that often are the size of multiple football fields and unpopular with local communities.

For a brief introduction to DLE, click here.

FOLLOW & JOIN 247Solar

LinkedIn US, LinkedinEU, Twitter, YouTube

Contact: info@247solar.com