CLOSING THE ENERGY INVESTMENT GAP

Source: IEA/Cipher

Leading up to this year’s COP28 climate summit in Dubai, Cipher is publishing a series of articles examining an energy investment gap affecting low-and middle- income countries. Their kick-off piece begins with some good news, at least from the global perspective.

“Investment into renewable energy infrastructure will reach $1.7 trillion this year, compared to just $1 trillion for fossil fuels,” writes Cipher’s Bill Spindle. This year, “more than $1 billion per day is flowing into solar power alone … (and) solar investments will likely surpass investment in oil production for the first time ever in 2023.”

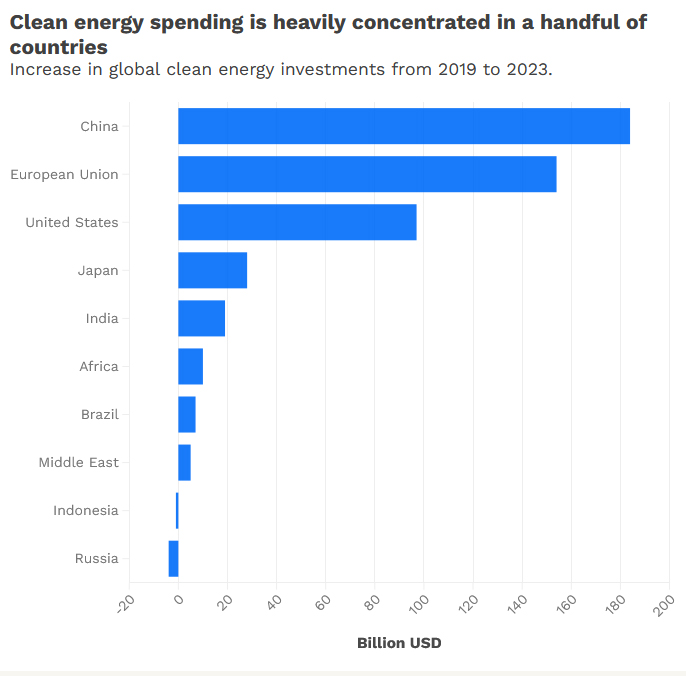

Unfortunately, “very little of that investment, just three dollars out of ten, is going to low- and middle-income countries, where most of the new demand for energy will occur in the coming decades.” According to the United Nations, “these countries need about $1.7 trillion annually in clean energy investment — equal to the total amount of global investment in renewables this year — but received only $544 billion last year.”

Most glaring is the shortfall in Africa, where, according to Binit Das of Down To Earth, some 30 countries fail to provide basic electricity access to their populations and more than 60% of Africans face “acute energy poverty.” Spindle quotes Ajay Mathur of the International Solar Alliance who says, “The vast amount of investment is occurring in the economically developed democracies and China — something like 70%. Meanwhile, all of Africa gets at most 3%.”

Development banks must step up

World Bank

Cipher’s Anca Gurzu writes in a follow-up article that multilateral development banks have a key role to play in addressing this disparity, and there appears to be movement in a positive direction. Gurzu quotes Rishikesh Ram Bhandary, assistant director of the Global Economic Governance Initiative at Boston University’s Global Development Policy Center: “There is a broad agreement that multilateral development banks can and should be playing a much bigger role in climate change financing because they can provide loans with a much longer duration compared to banks on the ground and with better or more concessional interest rates.”

In response, the World Bank came out last year with a roadmap meant to re-envision its mission, operations and resources. And this year, at the annual World Bank meeting, which starts October 9 in Morocco, the board of governors, together with finance ministers, private sector executives and others, will discuss modifying the bank’s ‘capital adequacy’ rules to free up more capital for loans.

If approved, these rules changes will allow the bank to make more loans with existing funds. A July report from an independent expert group commissioned by the Group of 20 countries found that endowing multilateral banks with more capital is also necessary. That finding raised the question of asking for additional contributions from shareholding countries, something many shareholders have resisted. Bhandary says it’s important that calls for fresh capital increase, despite shareholder resistance. “We need to avoid saying there is no appetite because it is clear that what we need is more capital,”

Read more here.

Long-duration storage with 24/7 dispatchability

Extreme weather, variable PV and wind, and aging infrastructure are straining grids. At times, grids can be overwhelmed by too much power from PV or wind. At other times aging infrastructure coupled with the often widely variable demand outstrips a grid’s ability to provide reliable electricity.

As a battery, HeatStorE converts stored heat to both heat and power (CHP) as needed for 9 hours or more on a single charge.

As a backup system, HeatStorE produces both heat and power even when fully discharged by burning any locally available fuel, even hydrogen, ensuring 24/7 operation during even the longest grid outages.

HeatStorE enhances energy security and provides peace of mind with:

- Full uptime during natural emergencies or supply disruptions

- Fully dispatchable, 24/7 standby heat and power on demand

- Increased energy system reliability & operational flexibility

MAKING THE MOST OF NEGATIVE ENERGY PRICES

iStock

Negative electricity prices are a real and growing phenomenon in energy markets that present some interesting opportunities. As increasing amounts of intermittent solar and wind generation are added to grids, the result is more frequent mismatches between electricity supply and end-user demand.

As Dr. Alistair Martin, founder of UK-based demand-response business Flexitricity explains in an article for Energy Storage News, negative electricity pricing occurs when system operators don’t have an off-taker for all of the renewable generation that’s available. Thus, says Martin, the operator “is forced to choose between paying generators to turn down or paying customers to use more. The more customers are willing to put the available green energy to work, the less the system operator has to buy down the solar and wind farms. Generally, paying customers to consume is the cheaper option.”

Martin continues, “Businesses with the ability to adjust when they consume energy or store it … have a lot to gain from negative pricing events.” Batteries can enable businesses to maximize these opportunities. Say Martin, “A battery can effectively be paid twice from a single negative pricing event, by charging while prices are negative, and discharging when positive prices return.”

Batteries can assist on the supply side as well. They allow solar and wind farms to store energy during times of peak generation, which often occur when demand is low – for solar in mid-day and for wind often at night. They can then release the stored electricity when demand (and prices) are higher, enabling them to fully utilize their generation capacity without curtailment and realize revenue during more of the day.

Read more here.

RANKED: THE MOST CARBON-INTENSIVE SECTORS IN THE WORLD

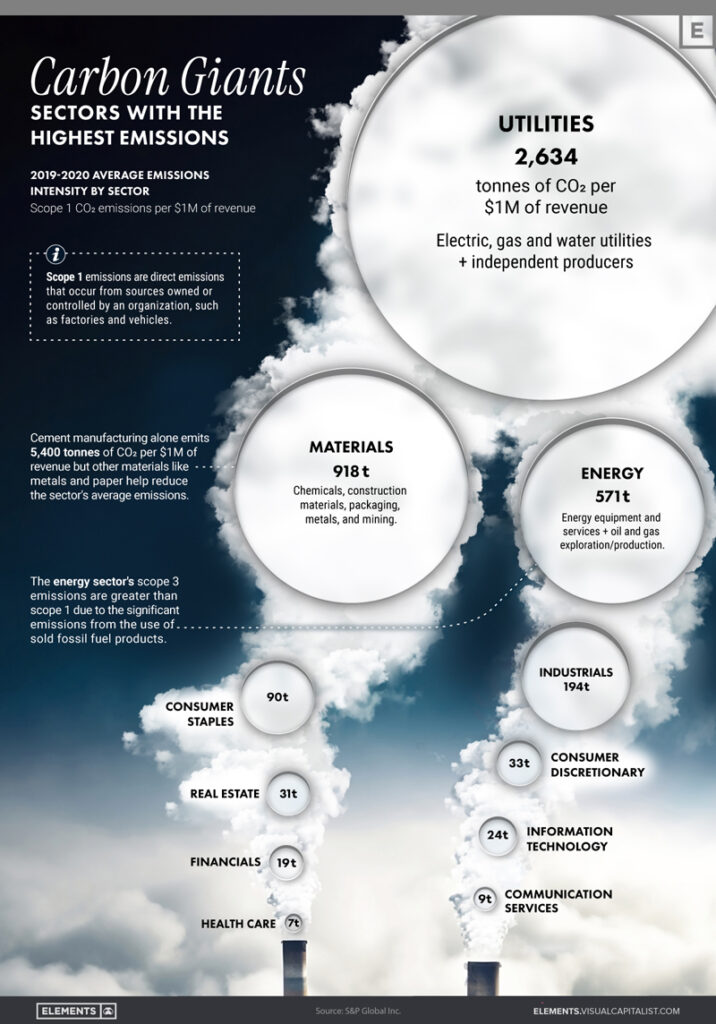

Thanks to Visual Capitalist for a great chart (at right) showing the sectors with the highest CO2 emissions, in appropriate scale. Based on an analysis by S&P Global, Inc., the chart shows only Scope 1 emissions – defined as direct emissions related to manufacturing or creating a company’s products – ranked by tonnes of CO2 per $1M of revenue.

Thanks to Visual Capitalist for a great chart (at right) showing the sectors with the highest CO2 emissions, in appropriate scale. Based on an analysis by S&P Global, Inc., the chart shows only Scope 1 emissions – defined as direct emissions related to manufacturing or creating a company’s products – ranked by tonnes of CO2 per $1M of revenue.

The data excludes indirect Scope 2 (upstream) and Scope 3 (downstream) emissions. In addition to highlighting the predominance of the utility sector in the overall emissions picture, the chart and accompanying narrative provides additional insights including:

- The energy sector’s scope 3 emissions are greater than its scope 1, due to emissions from the use of the sector’s fossil-fuel based products.

- Though overall scope 1 emissions of the materials sector are lower than utilities on a tonnes/revenue basis, cement manufacturing alone produces twice as much CO2 per $1M revenue as does the utilities sector overall.

Read more.

FOLLOW & JOIN 247Solar

Contact: info@247solar.com