LEADING INSIGHTS FROM AFRICAN MINING INDABA

African Mining Indaba is Africa’s foremost mining event. This year the focus was on the global energy transition, and Africa’s potentially pivotal role in providing many of the key minerals required to wean humanity off of fossil fuels. Two important themes from the conference were highlighted together in an excellent article from global consultancy Wood Mackenzie.

African Mining Indaba is Africa’s foremost mining event. This year the focus was on the global energy transition, and Africa’s potentially pivotal role in providing many of the key minerals required to wean humanity off of fossil fuels. Two important themes from the conference were highlighted together in an excellent article from global consultancy Wood Mackenzie.

The authors, Robin Griffin, Vice President-Metals and Mining Research, and Nick Pickens, Research Director-Global Mining, describe a US$1.2 trillion opportunity but note multiple disconnects that are hampering the African continent’s ability to realize its potential.

“The unanimous call to action,” the authors say, “(was) that an extraordinary investment in new mines is needed, and soon.” But also, “there seemed little disagreement that for energy transition metals – lithium, copper, nickel, cobalt, vanadium and graphite, among others – there is currently a mismatch between future demand and the ability for industry to deliver.”

The need is enormous. WM’s numbers suggest that in order to reach Paris Agreement targets of zero carbon by 2050, copper and aluminium production must double, nickel output needs to rise three-fold and the world will require nine times the amount of lithium produced today (read more on the scale of the demand below).

Slow development

Unfortunately, the authors say, project development rates are falling short, resulting in constraints in delivering new mine supply. Why?

A major reason, they assert, “is that cash is being returned to shareholders, rather than being re-invested into growth. This keeps investors happy but starves the industry of the necessary investment to meet future energy demand.” That, and what the authors call “the carbon reduction investment dilemma.”

“For governments, regulators and communities,” they say, “there is a much stronger emphasis on reducing carbon emissions than developing mines … Mining companies [are] obliged to invest in carbon abatement. It is required by some regulators, it seems to make sense from an emissions reduction perspective and, when factoring in the impact of carbon taxes, investing capital in carbon abatement rather than new mining projects can also provide better returns.”

“Ideally,” the authors say, “we should be investing in both emission reduction and new mines for vital energy transition metals.”

The role of Africa

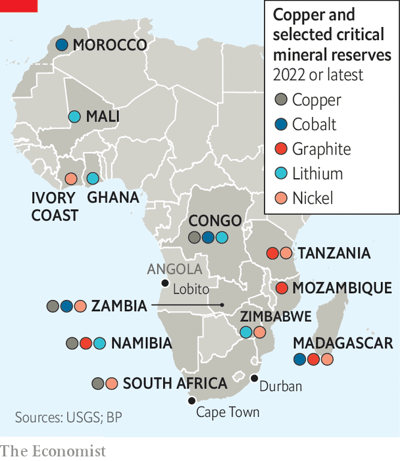

The authors then pivot to a discussion of the important role the African continent at least has the potential to play. With Africa having around 30% of global mineral wealth, “There was a pervasive undercurrent of hope. But there was also realism.”

“Change’” they write, ”is required to enable the mining sector to reach its potential,” with “energy, logistics and ESG risk [the] constant themes.”

First, “Energy reliability and the slow pace of renewable penetration is constraining the move into downstream processing, and restricting the benefits of clean energy to African communities.”

“Logistics too,” they continue, “must be a priority, whether it’s underperforming rail assets constraining critical mineral supply from South Africa’s northern cape, or weeks-long delays on concentrate supply across the DR Congo/Zambian border.”

ESG risks were the most common refrain. “Large and diversified miners in Africa are expanding production but, aside from copper/cobalt in DR Congo, growth rates are slow. Larger mining houses are focusing on decarbonization at existing sites – a sensible and noble aim, but not conducive to rapidly meeting the supply of critical minerals.”

Realizing the opportunity

“There is much hard work to do if Africa is to make the most of its enormous mineral wealth,” the authors conclude, “And no shortage of ideas … Change will not happen overnight – this is an energy transition after all. But the chances of success in achieving zero carbon are greatly increased with stakeholders pulling in the same direction.”

Read the full Wood Mackenzie piece here.

A ROUND-THE-CLOCK CLEAN ALTERNATIVE TO FOSSIL FUELS

Achieving high levels of renewable energy is particularly challenging for off-grid mines in remote locations because intermittent PV or wind with costly batteries still require dirty, expensive diesel for backup. Many mines also require high-grade heat for on-site processing and other uses. 247Solar offers the only renewable energy technologies that:

- Integrate seamlessly with PV or wind to provide round-the-clock clean electricity

- Provide industrial grade heat up to 970 ℃ (1800 ℉) for ore processing, steam generation and other applications

- Provide their own backup by burning almost any locally available fuel to produce power even when storage is depleted, eliminating gensets and reducing fuel costs up to 80%

Get in touch to learn more

MORE FROM MINING INDABA – U.S. STEPPING UP

The Economist reports that this year’s Mining Indaba attracted America’s largest delegation ever, including officials from the White House and departments of state, commerce and energy. “Its size,” the Economist infers, “reflects America’s hunger for the 50 “critical minerals” it deems essential to reduce carbon emissions and create green jobs in the process.” And, “by pledging to do mining differently—both from how China does it now and how the West has in the past—America hopes its initiative will help transform African economies.” The article quotes Amos Hochstein, U.S. President Joe Biden’s energy security advisor, as saying, “The energy transition is an opportunity for an Africa transition.”

The Economist reports that this year’s Mining Indaba attracted America’s largest delegation ever, including officials from the White House and departments of state, commerce and energy. “Its size,” the Economist infers, “reflects America’s hunger for the 50 “critical minerals” it deems essential to reduce carbon emissions and create green jobs in the process.” And, “by pledging to do mining differently—both from how China does it now and how the West has in the past—America hopes its initiative will help transform African economies.” The article quotes Amos Hochstein, U.S. President Joe Biden’s energy security advisor, as saying, “The energy transition is an opportunity for an Africa transition.”

According to the author(s), “American officials see Africa as helping to solve two problems. The first is a global shortfall in the minerals that will be needed if the world is to meet its climate goals … The second problem, at least for the West, is China’s outsized influence on supply chains. China refines 68% of the world’s nickel, 40% of copper, 59% of lithium and 73% of cobalt … Though China is less dominant in mining, where its firms compete with multinational majors, Western governments are concerned that, without additional supply, firms will struggle to feed new downstream processing facilities that officials are keen to see built in friendly countries.”

America will need to walk its talk if its initiative is to be successful, however. “African priorities are often not American priorities,” the authors assert, quoting a mine CEO: “It is not enough just to be America.” The article describes how Sameh Shenouda, the executive director of the Africa Finance Corporation, welcomes renewed Western interest in African mining, but worries that projects will take too long to get started because of American bureaucracy, and that America’s push to ally ESG-friendly investing with mining may not endure under a Republican president.

Says a former adviser to an African president. “China’s success in Africa … is because their firms can get projects done in time for the next election.”

Read more here.

EXPLAINER: MASSIVE DEMAND FOR CRITICAL MINERALS

Cypher is a superb newsletter supported by Bill Gates’ Breakthrough Energy. A recent issue summarized some staggering numbers associated with the exploding demand for critical minerals to support the energy transition. Start with the sources of demand. According to author Anca Gurzu:

- A typical electric car requires six times the amount of minerals of a conventional car.

- An onshore wind plant requires nine times more minerals than a gas-fired power plant.

- Since 2010, the average amount of minerals needed for one new unit of power generation capacity has increased by 50% as the share of renewables has risen.

- To reach net-zero emissions by 2050, the global cleantech sector’s demand for copper, lithium, cobalt, nickel and neodymium (a type of rare earth mineral) will range between three to 14 times higher in 2030 than in 2021.

What are the implications for miners?

Copper, according to the IEA is “the cornerstone for all electricity-related technologies.” The material, together with aluminium, is important for the expansion of power networks and the production of wind turbines, solar panels and electric vehicles. Of five key minerals including lithium and cobalt, copper demand will see the highest increase in terms of volume—just over one million tonnes per year on average by 2030, 90% of which will go toward clean technologies.

Gurzu quotes Eric Toone, a chemist and technical lead for Breakthrough Energy Ventures, as saying, “By some estimates, we will use more copper in the next 30 years than humanity has used in its entire existence.”

Beyond copper, Gurzu writes, “lithium, nickel, cobalt, manganese and graphite are crucial to battery performance and longevity. Rare earth elements, such as neodymium, are key for building powerful magnets needed in wind turbines. Hydrogen electrolysers and fuel cells require nickel or platinum group metals.”

According to Gurzu, Lithium has the fastest growing demand of any mineral. Lithium demand could grow by over 40 times by 2040, and the IEA suggests it’s possible that by 2030, almost all lithium on the market will be directed toward the battery sector.

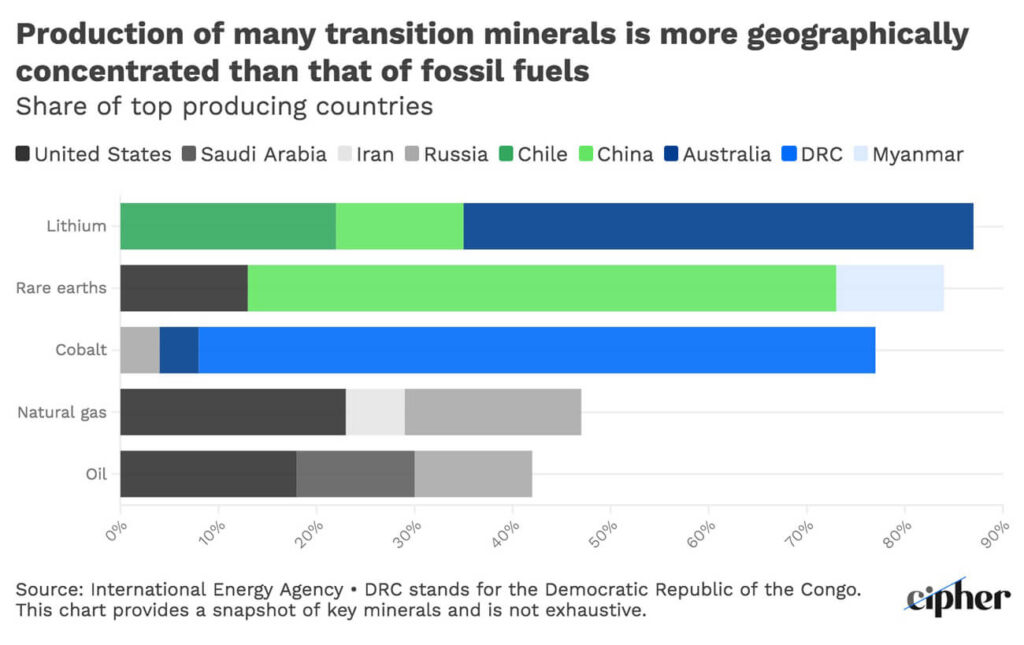

At the same time, production or many transition minerals is geographically concentrated. For example, The Democratic Republic of the Congo alone produces 70% of the world’s cobalt, and just three countries — Australia, Chile and China — account for nearly 90% of global lithium production. A similar pattern exists for platinum, rare earth elements and graphite.

At the same time, production or many transition minerals is geographically concentrated. For example, The Democratic Republic of the Congo alone produces 70% of the world’s cobalt, and just three countries — Australia, Chile and China — account for nearly 90% of global lithium production. A similar pattern exists for platinum, rare earth elements and graphite.

Clearly, demand will outstrip supply for most transition minerals for the foreseeable future, leading to great opportunities for miners nimble enough to take advantage.

Much more here.

NEWS FROM 247SOLAR

247Solar and Morocco’s Mohammed VI Polytechnic University to Study Solar-Powered Green Hydrogen and Ammonia Technology

247Solar has signed a Memorandum of Understanding (MOU) with Morocco’s Universite Mohammed VI Polytechnique (UM6P) to study the production of Green Hydrogen and Ammonia powered by 247Solar’s innovative next-generation Concentrated Solar Power (CSP) and thermal energy storage technologies.

247Solar has signed a Memorandum of Understanding (MOU) with Morocco’s Universite Mohammed VI Polytechnique (UM6P) to study the production of Green Hydrogen and Ammonia powered by 247Solar’s innovative next-generation Concentrated Solar Power (CSP) and thermal energy storage technologies.

The undertaking is intended in part to demonstrate the feasibility of producing Green Hydrogen/Ammonia to decarbonize fertilizer production, and is being partially funded by Morocco’s OCP Group, the world’s largest producer of phosphates. (Ammonia and phosphoric acid are used to produce ammonium hydrogen phosphate, a common inorganic fertilizer.)

Under the MOU, the parties form a strategic partnership to study the integration of green electricity and heat to supply two initial Green Hydrogen and Ammonia Pilots, and to explore its feasibility for large-scale production of green hydrogen and ammonia and possibly green desalination systems as well.

Read our press release here.

FOLLOW & JOIN 247Solar

LinkedIn US, LinkedinEU, Twitter, YouTube

Contact: info@247solar.com