5 STEPS FOR BOOSTING THE EU METALS INDUSTRY

PhonlamaiPhoto/iStock

Bloomberg (via Mining.com) reports that Europe’s top metal producers have called on the European Union to follow the White House’s lead in rolling out financial support to boost control of raw materials critical to the green-energy transition.

In a letter to EU leadership, Eurometaux — which represents major European producers including Glencore Plc, Boliden AB, and Aurubis AG — urged the EU to take inspiration from U.S. President Joe Biden’s Inflation Reduction Act, which includes billions of dollars of subsidies to spur domestic investment in electric vehicles and renewable energy.

The authors, Guy Thiran and Evangelos Mytilineos, Eurometaux Director General and President respectively, asserted, “The US Inflation Reduction Act, while discriminatory, has shown what a proactive clean tech industrial policy could look like. Its predictability, value chain approach, funding and tax incentives are driving new investments into US minerals production. We in Europe should be inspired by its example, and deliver more carrot and less stick to our industries, especially in today’s energy crisis. Let us drive decarbonisation through positive measures that reward climate action within an investment-attractive framework, as an alternative to unilateral (rules) and policy shifts.”

Investment lagging

The letter points out that “Europe’s energy transition risks 2030 bottlenecks for key metals, with investments lagging behind downstream needs and existing EU production threatened by the energy crisis.” For example, no new EU metals mines have opened in the last 15 years while global capacity has expanded. Europe has no processing capacity for lithium/rare earths, and today has 50% of aluminium & zinc and 30% silicon capacity offline (due to high energy prices), producing 2/3 less primary aluminium than in 2007.

“We need to change the paradigm,” the authors say, “that Europe is a less attractive place to invest … [by] addressing today’s high energy prices and regulatory uncertainty, while learning lessons from US minerals support.”

5 steps

Eurometaux proposed five key measures to help develop the EU metals industry:

- Set EU production targets, incentives, & project fast-tracking for the full clean energy technology supply chain, including strategic raw materials (mining, processing, recycling) together with downstream technology production.

- Deliver streamlined and comprehensive EU financial support for strategic supply chains, inspired by the IRA through CAPEX support & tax credits with fast approvals for strategic metals production and decarbonisation.

- Act urgently to reduce EU electricity prices, through improving long-term supply contract conditions, especially with renewable sources, and in the short-term considering temporary market-based measures for addressing high prices.

- Keep the Temporary Crisis Framework focused on mitigating the energy crisis, improving its provisions and Member State implementation to ensure a full recovery of Europe’s under-threat industries.

- Require regulatory predictability and coherence in other policy areas, for example:

- Incorporate industrial policy priorities into ongoing EU chemicals legislation reviews, aiming to prevent business uncertainty and unwarranted unilateral costs.

- Accelerate EU trade defence measures within the existing system, to safeguard new investments into nascent industries and address global market distortions.

“The time is now,” the authors conclude, “to deliver a powerful industrial policy which addresses the core framework conditions holding European companies back on the global level.”

Download the Eurometaux letter here.

24/7 CLEAN ELECTRICITY AND INDUSTRIAL-GRADE HEAT

An array of 247Solar HeatStorE long duration thermal batteries

Decarbonising both electricity and heat for mining and minerals processing is hard. PV and wind are intermittent, batteries are costly, and most facilities still require backup from dirty diesel or expensive natural gas. 247Solar offers the only renewable energy technologies that:

- Integrate seamlessly with PV or wind to provide round-the-clock clean electricity

- Provide industrial grade heat up to 970 ℃ (1800 ℉) for ore processing, steam generation and other applications

- Provide their own backup by burning almost any locally available fuel to produce power even when storage is depleted, eliminating gensets and reducing fuel costs up to 80%

Get in touch to learn more.

HUGE LITHIUM FIND A GAME-CHANGER FOR INDIA

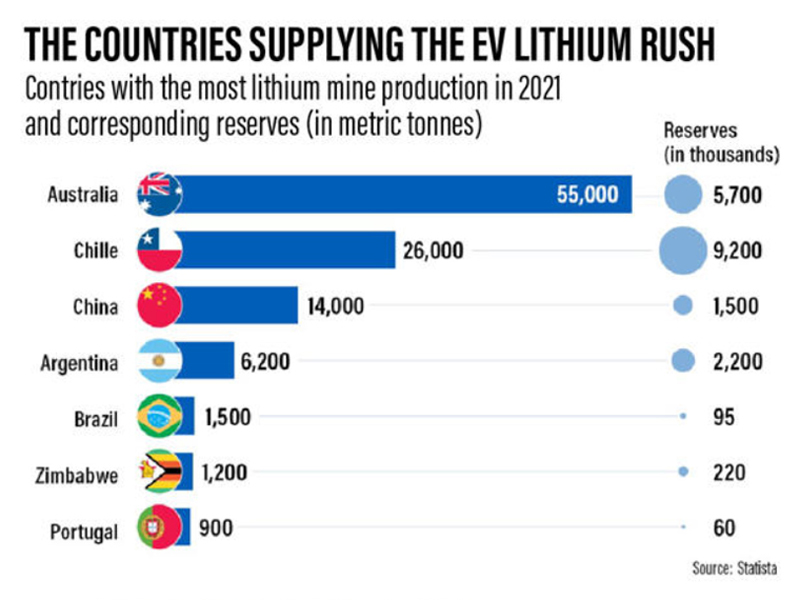

Mining Technology reports that the Indian Ministry of Mines has announced the discovery of 5.9 million tonnes of inferred lithium ore in the Himalayan provinces of Jammu and Kashmir. This deposit alone makes India — a country with no previously-known major lithium deposits — the country with the fifth-largest lithium reserves in the world.

This discovery is certain to invigorate India’s mining sector and, according to MT, draw dominance away from Chile, Argentina and Australia. Perhaps more importantly, increased domestic lithium production is expected to be a game-changer for India’s electric vehicle industry.

India is currently reliant on imports of lithium for its manufacturing sector, with Imported lithium comprising around 80% of the total lithium used in the country.

“The EV industry in India has been held back by a lack of reliable local lithium supply.” says Manvinder Singh Chugh, the founder and chairman of Aponyx Electric Vehicles, to MSN. India aims to have EVs account for 30 per cent of car sales by 2030, as the world’s soon-to-be most populous country strives to cut its carbon emissions and dependence on crude oil imports.

Read more here.

BHP’S HENRY: MINERS MUST INNOVATE TO GET MORE FROM EXISTING MINES

Per Australian Mining, BHP chief executive officer Mike Henry has urged the mining industry to take more risks on innovative technology if it wants to feed the energy transition’s appetite. Speaking at the World Economic Forum in Davos, Switzerland, Henry said that “miners should be squeezing more out of existing operations in addition to boosting new supply.”

Per Australian Mining, BHP chief executive officer Mike Henry has urged the mining industry to take more risks on innovative technology if it wants to feed the energy transition’s appetite. Speaking at the World Economic Forum in Davos, Switzerland, Henry said that “miners should be squeezing more out of existing operations in addition to boosting new supply.”

Henry urged the use of data, artificial intelligence (AI) and new technology to get the most out of established mines. He noted that BHP had been encouraged by its discovery of a significant new deposit within an existing site in South Australia, using new technology and new ways of sifting through data.

He said. “That’s the sort of breakthrough that will allow us to unlock more of the existing resource or footprint more efficiently.”

Read more.

FOLLOW & JOIN 247Solar

Contact: info@247solar.com