5 ENERGY AND CLIMATE TRENDS WORTH WATCHING IN 2023

Cipher is a newsletter from the Breakthrough Energy Network, Bill Gates’ venture capital fund and other interests focused on energy and climate. Their writers speak with great insight and authority, and when publisher Amy Harder offered five energy and climate trends she and her colleagues were watching in the coming year, we thought they merited sharing. Herewith:

Energy Security – Fossil Fuels

Says Harder, “Russia’s 2022 invasion of Ukraine catapulted national security to the forefront of arguments for tackling climate change through renewable energy investments.” True, but “Europe (now) lives a nightmare as it tries to build a future without Russian natural gas.” Fossil fuels are still today’s reality, disruptions in their supply can have global impacts, and both sellers and consumers have no choice but to continue to pursue new, more reliable sources until renewables are more widely adopted.

Energy Security – Clean Technology

Harder: “Security and resource risks aren’t just for fossil fuels. Such risks associated with cleantech are also becoming clearer as our dependence grows.” She quotes Eric Toone, technical investment lead at Breakthrough Energy Ventures: “[M]aterial availability issues … are going to frustrate deployment at scale.”

Harder: “Security and resource risks aren’t just for fossil fuels. Such risks associated with cleantech are also becoming clearer as our dependence grows.” She quotes Eric Toone, technical investment lead at Breakthrough Energy Ventures: “[M]aterial availability issues … are going to frustrate deployment at scale.”

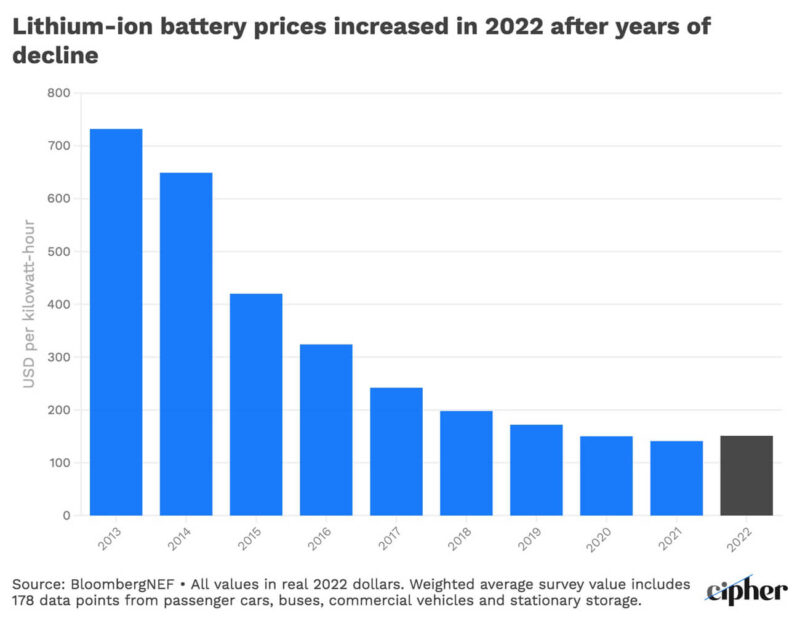

For example, prices of lithium-ion battery packs increased for the first time last year, according to BloombergNEF. Lithium is mostly processed in China, and demand has skyrocketed for both electric vehicles and storage for electricity generated by intermittent renewables. Says Toone, “Just a small fraction of vehicles today are battery-powered and we’re already running into these challenges.”

Inflation Reduction Act

Harder says that “After Russia’s invasion of Ukraine, the Inflation Reduction Act was 2022’s other big surprise. The law is directing nearly $370 billion into clean energy subsidies and related programs with potential impacts in Washington D.C., across the United States, and around the world.”

In Washington, implementation of the measure is certain to face challenges from a new divided Congress. Across the U.S., Cipher expects rapid growth of—and growing opposition to—all types of clean energy, from wind and solar to more novel technologies like renewable hydrogen, carbon dioxide pipelines and direct air capture facilities.

Globally, the IRA is frustrating some U.S. allies, especially in Europe, by imposing restrictions or offering additional subsidies for some North American-made clean energy products.

Jobs and Infrastructure

Harder asserts, and we agree, that “Communities, states and countries dependent on fossil fuels are unlikely to fully embrace clean energy replacements until or unless they can ensure companies and state-owned enterprises won’t face a massive set of financially stranded fossil fuel assets and also gain confidence their workers will still have jobs.”

Adaptation as well as Mitigation

Climate-fueled extreme weather received is a fact of life today, and Cipher expects that “adaptation will continue to get more attention across the economy, including from governments, corporations and venture capitalists.” Toone’s Breakthrough Energy Ventures is looking to commercialize companies that can make money responding to extreme weather and other impacts of a warming world. He says, “While BEV’s principal focus will continue to be mitigation, we will now work on adaptation as part of our portfolio.”

In 2023, each of these trends is likely to be relevant to stakeholders up and down various energy/technology value chains, governments, NGOs and ordinary citizens across the globe. Read the full Cipher piece here.

Energy security for both electricity and heat from simple, abundant materials

People and businesses need both electricity and heat to survive and thrive. 247Solar’s HeatStorE™ thermal battery captures energy from PV, wind or the grid and stores it as heat in cheap, plentiful materials like sand or iron slag.

As a battery, HeatStorE converts stored heat to both heat and power (CHP) as needed for 9 hours or more on a single charge. As a backup system, HeatStorE produces both heat and power even when fully discharged by burning any locally available fuel, even hydrogen, ensuring 24/7 operation during even the longest grid outages.

HeatStorE enhances energy security and provides peace of mind with:

- Full uptime during natural emergencies or supply disruptions

- Fully dispatchable, 24/7 standby heat and power on demand

- Increased energy system reliability & operational flexibility

A DEVILISH DUALITY – BALANCING SUSTAINABILITY WITH RESILIENCE

Aleksandr Simonov – Shutterstock

Global consultancy McKinsey and Company can be counted on for thought-provoking content. In a recent post, they present what they call a devilish duality facing leaders trying to drive a net-zero carbon emission transition. “(In view of) the challenges to deploying capital at scale, managing economic dislocations, and scaling up supply chains and infrastructure … countries and companies must balance trade-offs among net-zero commitments, affordability for citizens, and security of energy and materials supply,” they say.

“As net zero has become an organizing principle for business, executives are on the spot to lay out credibly how they will deliver a transition to net zero while building and reinforcing resilience against the certain volatility of ongoing economic and political shocks. The zigs and zags of present conditions will tempt some leaders with exclusive choices—doubling down on fossil fuels, for example, at the expense of new and emerging renewable technologies.”

McKinsey lays out 5 actions leaders can take to balance resilience with an energy future that is secure, affordable, and clean. Learn what they are here.

GREEN LENDING TOPS FOSSIL FUELS FOR THE FIRST TIME

According to Bloomberg, more money was raised in debt markets for climate-friendly projects than for fossil-fuel companies for the first time in 2022. However, there’s a catch.

Says Bloomberg’s Tim Quinson, “it’s not that green financing is finally winning out over fossil fuel lending. Rather, Big Oil looks to be getting more money from elsewhere.” Quinson quotes April Merleaux, research manager at the environmental nonprofit Rainforest Action Network, as saying “We’re … seeing fossil-fuel companies turn to less traditional sources of capital, such as private equity.” While this may mean that overall investment in fossil fuels continues to outstrip renewables, the chart shows that green investment is nonetheless on the rise, a necessary pre-condition for the energy transition. Read the Bloomberg article here.

Says Bloomberg’s Tim Quinson, “it’s not that green financing is finally winning out over fossil fuel lending. Rather, Big Oil looks to be getting more money from elsewhere.” Quinson quotes April Merleaux, research manager at the environmental nonprofit Rainforest Action Network, as saying “We’re … seeing fossil-fuel companies turn to less traditional sources of capital, such as private equity.” While this may mean that overall investment in fossil fuels continues to outstrip renewables, the chart shows that green investment is nonetheless on the rise, a necessary pre-condition for the energy transition. Read the Bloomberg article here.

NEWS FROM 247SOLAR

Happy New Year!

All of us at 247Solar would like to wish our readers around the world a new year filled with peace, hope, good will, and of course progress toward a sustainable world powered by low cost, clean energy.

All of us at 247Solar would like to wish our readers around the world a new year filled with peace, hope, good will, and of course progress toward a sustainable world powered by low cost, clean energy.

FOLLOW & JOIN 247Solar

LinkedIn US, LinkedinEU, Twitter, YouTube

Contact: info@247solar.com